This Month's Issue:

A Paradigm Shift is Happening

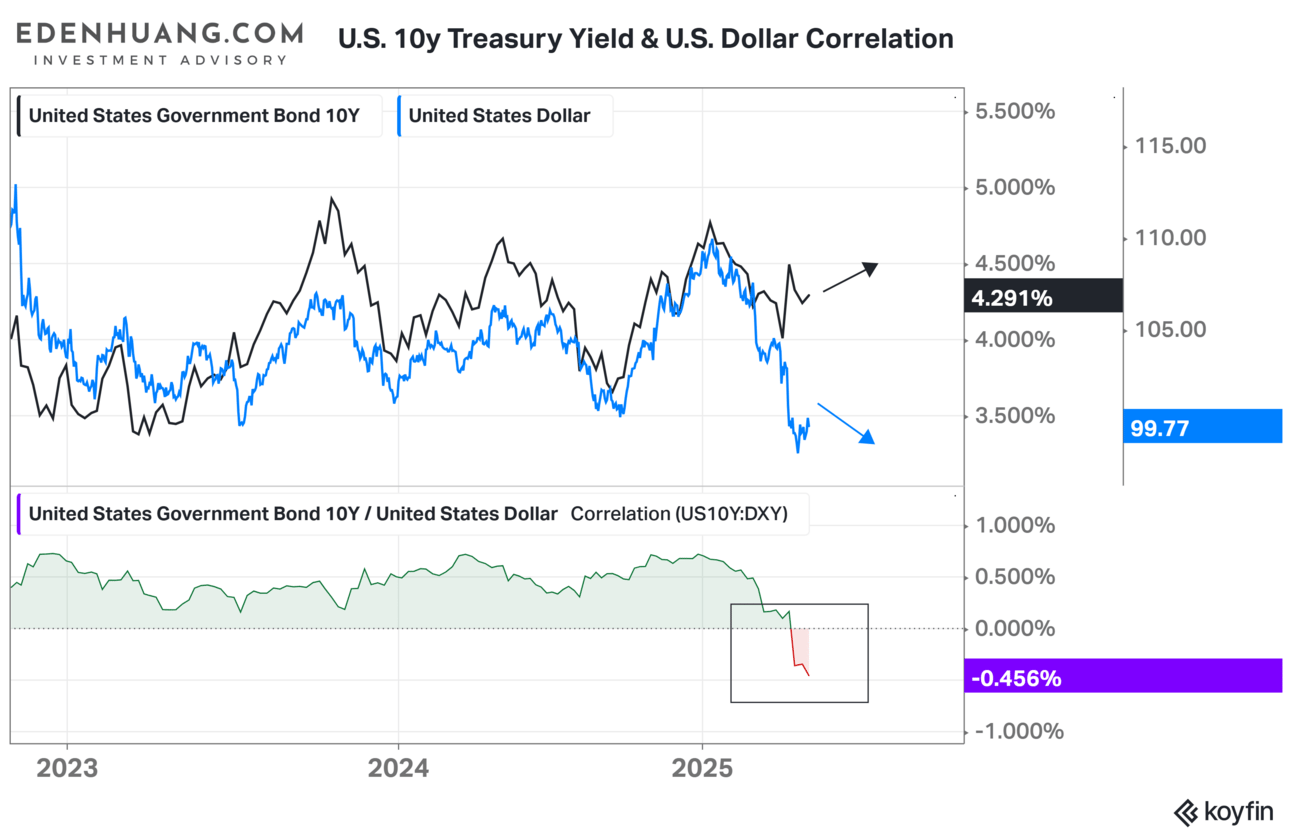

Investors are witnessing a fundamental shift in financial markets—what was once a predictable relationship between U.S. Treasury yields and the U.S. Dollar is now unraveling. Historically, rising 10-year Treasury yields bolstered the dollar as global investors flocked to U.S. assets for higher returns. However, this correlation has turned negative, signaling a potential shake-up in market dynamics.

U.S. 10y Treasury Yield & U.S. Dollar Correlation

The relationship between U.S. 10-year Treasury yields and the U.S. dollar and is a crucial dynamic in global financial markets. Traditionally, these two move in tandem—higher Treasury yields attract foreign investment, strengthening the dollar. However, shifts in economic conditions, monetary policy, and investor sentiment can disrupt this correlation.

Key Factors Driving the Relationship

Interest Rate Expectations Treasury yields reflect investor expectations of future interest rates. When yields rise, it often signals that the Federal Reserve may tighten monetary policy, making U.S. assets and Treasuries more attractive and boosting the dollar. Conversely, falling yields suggest lower rates, reducing demand for the dollar.

Risk Sentiment & Safe-Haven Demand the U.S. dollar is a global safe-haven asset. In times of uncertainty, investors flock to Treasuries, driving yields lower while strengthening the dollar. However, in risk-on environments, investors may seek higher-yielding assets elsewhere, weakening the dollar.

Inflation & Real Yields Inflation erodes the purchasing power of fixed-income investments like Treasuries. If inflation expectations rise faster than nominal yields, real yields (adjusted for inflation) decline, making U.S. assets less attractive and potentially weakening the dollar.

Foreign Investment & Capital Flows Higher Treasury yields can attract foreign capital, increasing demand for dollars. However, if global investors perceive U.S. debt as risky due to fiscal deficits or geopolitical concerns, they may reduce exposure, weakening the dollar despite rising yields.

Recent Paradigm Shift

Historically, rising Treasury yields have strengthened the dollar. However, recent trends show a negative correlation, where higher yields coincide with a weaker dollar. This shift suggests that factors like inflation concerns, Growth concerns, and global diversification are influencing investor behavior differently than before.

Inflation Concerns

The U.S. is grappling with mounting inflation concerns as blanket tariffs reshape trade dynamics and consumer expectations hit historic highs. President Trump's aggressive tariff policies, initially aimed at addressing trade imbalances, have fueled inflationary pressures, with American consumers now anticipating a 6.7% price increase over the next year—the highest recorded since 1981.

Growth Concerns

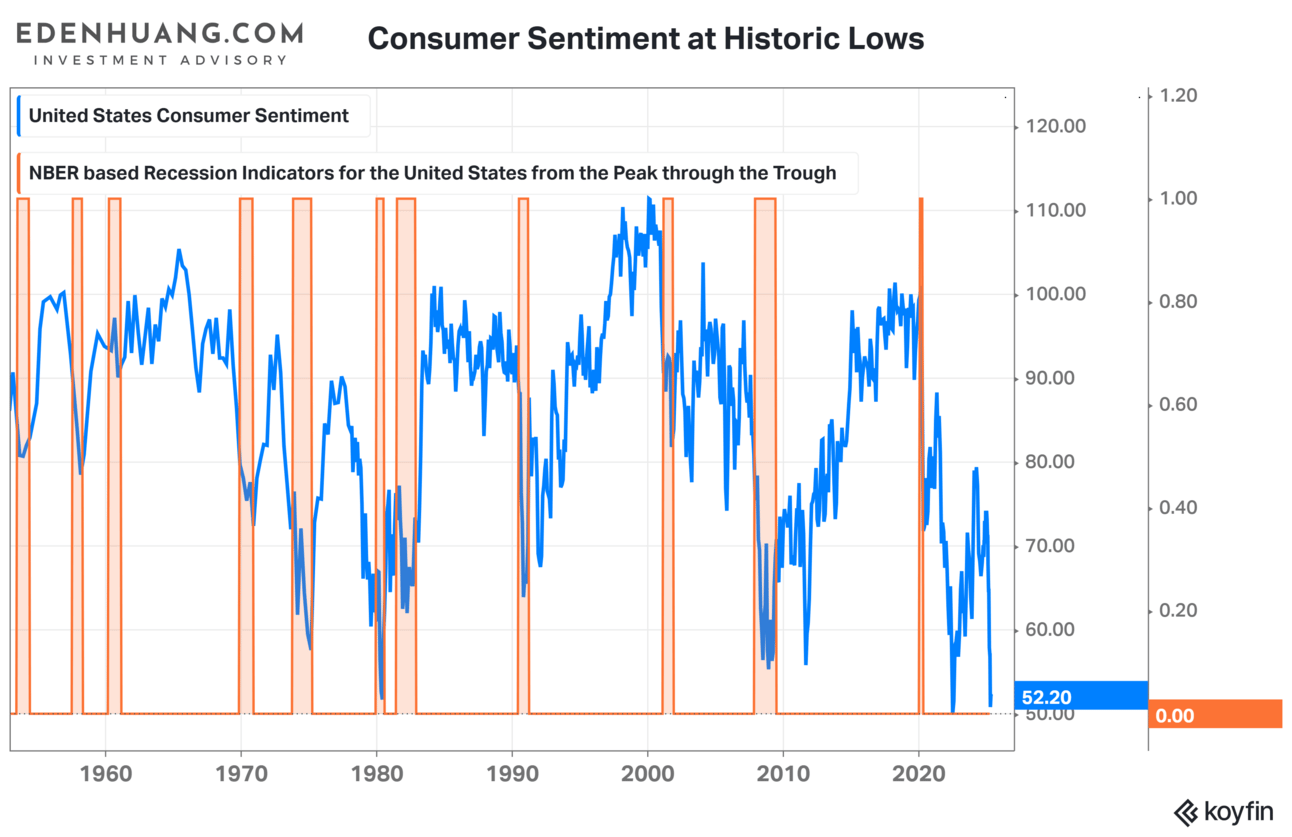

The Michigan Consumer Sentiment Index has plunged to 52.2, marking its lowest level since the 2008 financial crisis. This sharp decline signals deepening economic uncertainty, as consumers grow increasingly wary of inflationary pressures and trade policy volatility.

Historically, such sentiment declines have translated into slower GDP expansion, as cautious households cut back on discretionary purchases, dampening business revenues and investment. If confidence continues to erode, policymakers may need to intervene with targeted fiscal measures to stabilize growth and restore consumer optimism.

Understanding the Paradigm Shift:

How did we get here?

The U.S. economy's current challenges stem from a mix of protectionist policies, inflationary pressures, and shifting consumer sentiment. Trump's tariffs, initially introduced to counter perceived unfair trade practices, have evolved into a broader economic strategy, reshaping supply chains and consumer prices. While aimed at protecting domestic industries, these tariffs have contributed to rising costs, fueling inflation concerns and dampening consumer confidence.

The Michigan Consumer Sentiment Index has plummeted to historic lows, reflecting widespread uncertainty despite moderating inflation and rising wages. Consumers perceive their purchasing power as eroding, even though verified spending remains strong. This disconnect between sentiment and actual economic behavior complicates growth forecasts, as lower confidence often translates into reduced spending and investment.

With interest payments on federal debt surpassing $1 trillion for the first time in the history of the United States, policymakers face mounting pressure to balance fiscal sustainability with economic stability. The urgency of addressing these issues is heightened by the need to refinance over $5 trillion in federal debt annually, further straining government resources.

The road ahead remains uncertain, with protectionist policies, inflation expectations, and consumer sentiment shaping the trajectory of U.S. economic growth.

How will all this affect the rest of the world?

The weakening U.S. dollar and slowing U.S. growth are reshaping global economic dynamics, particularly in Asia, where trade and investment flows are deeply tied to the American economy.

Impact on Asia

Export Competitiveness – A weaker dollar makes Asian exports more expensive for U.S. consumers, potentially dampening demand for goods from countries like China, Japan, and South Korea.

Capital Flows – Emerging Asian economies, such as India and Indonesia, often rely on foreign investment. A weaker dollar could attract capital inflows, as investors seek higher returns in Asian markets.

Debt Burden – Many Asian nations hold U.S. dollar-denominated debt. A weaker dollar reduces the cost of servicing this debt, easing financial strain on governments and corporations.

Commodity Prices – Since commodities like oil and gold are priced in dollars, a weaker dollar boosts demand for these assets, benefiting resource-rich Asian economies.

Impact on the Rest of the World

Global Trade Disruptions – Countries that rely on U.S. imports may face higher costs, leading to inflationary pressures in regions like Europe and Latin America.

Financial Market Volatility – Investors worldwide are adjusting portfolios in response to U.S. fiscal policies, causing fluctuations in stock markets and currency valuations.

Central Bank Dilemmas – Foreign central banks may need to intervene to stabilize their currencies, particularly in Europe and emerging markets, where a weaker dollar can inflate local currencies and hurt export competitiveness.

THE MACRO GPS

In the following Sections we track and monitor:

Key U.S. recession indicators, such as unemployment trends, yield curve patterns, and consumer confidence indices, offer early signals of economic downturns, enabling proactive decision-making.

Global economic conditions, including GDP growth rates, trade dynamics, and inflation pressures, provide insights into the interconnected nature of economies and their cascading impacts on various markets.

Market cycle markers—help identify shifts in investment opportunities and risks. Together, these metrics allow investors stay ahead of economic trends and optimize their strategies for resilience and growth.

OUR ASSET ALLOCATION STRATEGY

In the following Sections, we share with clients and subscribers our asset allocation strategy based on Recession indicators, Global Economic Conditions, Market Cycle Markers. We will try to objectively tailor our advisory practice around the following asset allocation strategy and review the performance.

Subscribe to Non-Clients to read the rest.

Become a paying subscriber as Non-Clients to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦