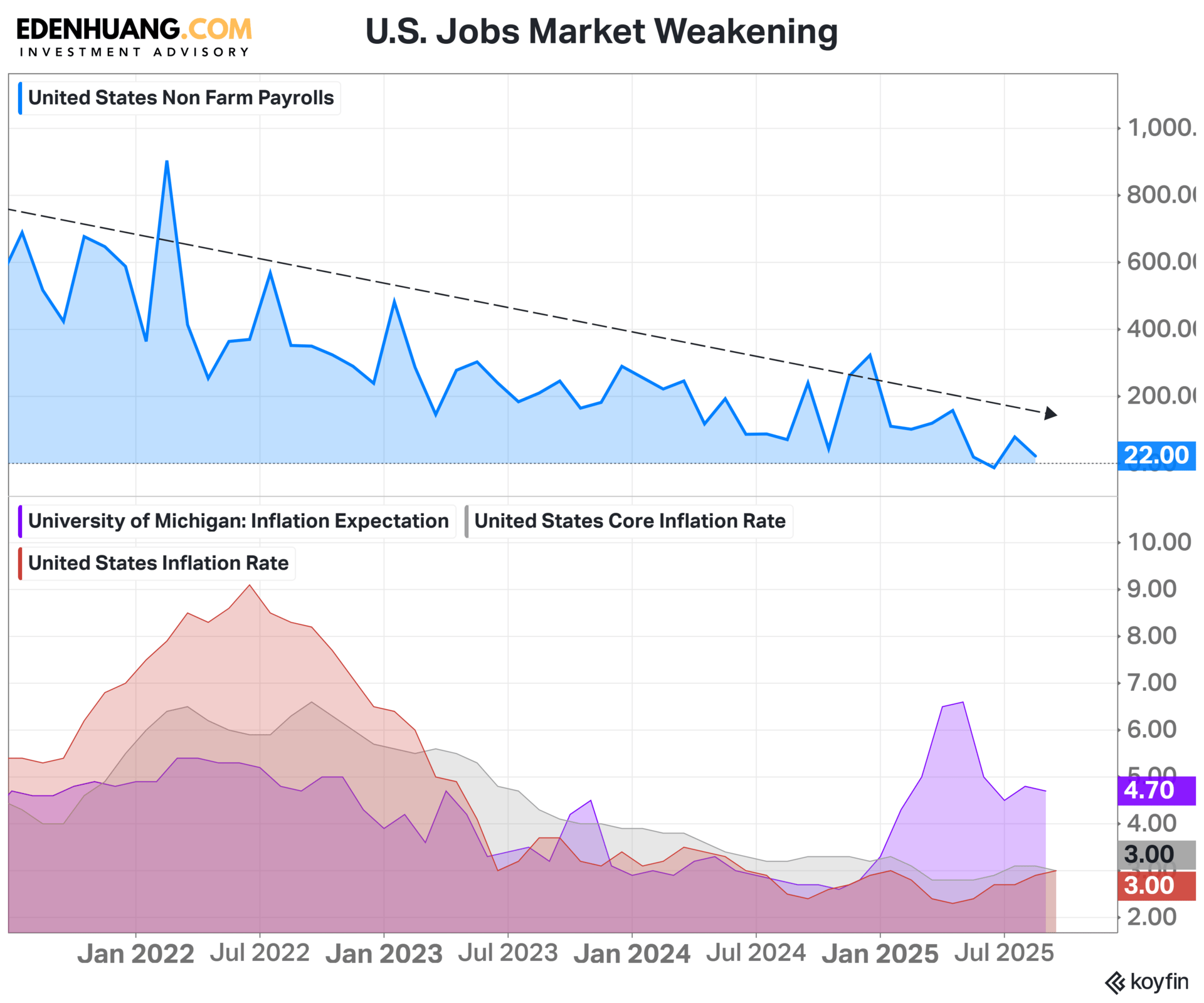

When the Fed says in the latest press conference that “rates are not on a pre-set course”, what it really means is: “we have no map, only constraints”. Inflation is still running hotter than they’d like, and the labor market is now flashing weakness.

How Did We Get Here? We arrived at this juncture not by accident, but by design. For over a decade, the Fed engineered an environment of artificially cheap money—first to rescue markets from crisis, then to sustain growth that could not stand on its own.

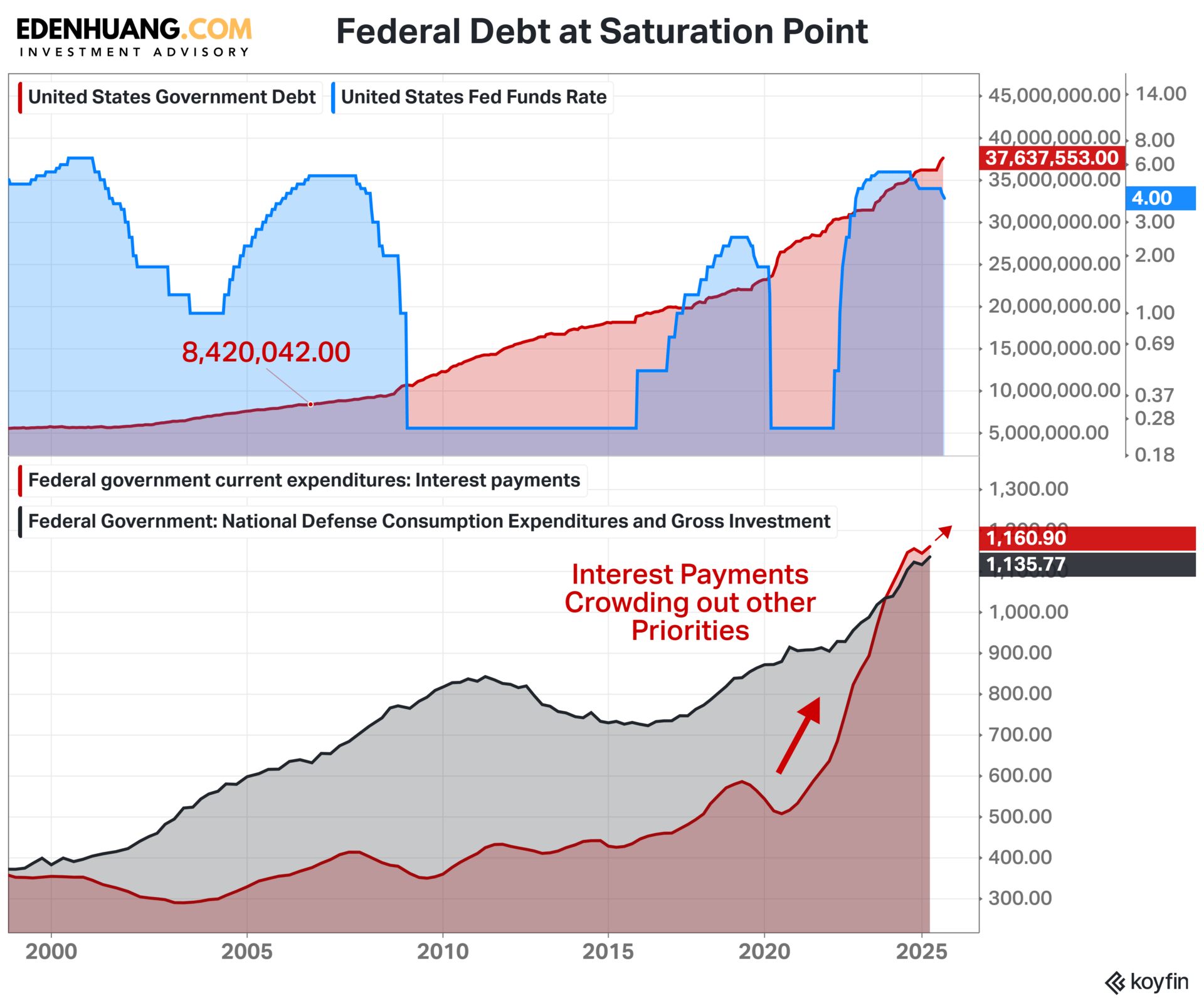

Today’s Rate Hike vs. Pre‑2008 A 25‑basis‑point hike today is not the same animal as a 25‑basis‑point hike before 2008. Back then, public and private balance sheets were lighter, and debt service costs barely rippled through the system. Today, with federal debt north of 120% of GDP and corporate leverage piled high, every incremental move in rates translates into a vastly larger interest bill. What once was a policy “nudge” is now a fiscal shock absorber snapping under strain. The Fed may be raising rates in quarter‑point steps, but the compounding effect on interest payments is exponential compared to the pre‑crisis world. In other words, the same tool now carries a far heavier consequence—because the denominator of debt has swollen beyond recognition.

U.S. labor market is softening into higher inflation expectations, creating a dangerous policy bind. The cracks in employment—slower hiring, rising jobless claims, and waning wage momentum—signal that the economy’s growth engine is losing steam. Yet at the same time, inflation expectations remain elevated, reflecting sticky prices in services, housing, and energy. This combination is toxic: a weakening jobs market usually calls for easing, but persistent inflation risk demands restraint. The implication is that the Fed cannot act as a stabilizer in the traditional sense. Instead, it is forced into a lose‑lose posture—tightening risks accelerating job losses, while easing risks entrenching inflation psychology. For investors, this means volatility is not a passing phase but a structural feature of the landscape. Portfolios must be stress‑tested for both stagflationary drag and policy paralysis, because the old playbook of “bad jobs data equals dovish Fed” no longer applies.

THE BOTTOM LINE

For years, policymakers treated debt as a free resource, enabled by artificially low rates and relentless liquidity injections. This “easy money era” didn’t just smooth over crises—it rewired the economy around leverage. Governments borrowed as if interest costs would never matter, corporates refinanced endlessly, and households were nudged into asset bubbles. The result was a swelling M2 money supply, which surged most dramatically during the pandemic stimulus, expanding faster than output and embedding excess liquidity into every corner of the system.

Inflation is the inevitable residue: too much money chasing too few goods, compounded by structural debt that now limits the Fed’s ability to respond. In today’s regime, debt dictates policy, M2 amplifies its effects, and inflation is the symptom of both. For investors, the lesson is clear—this is not a temporary cycle but a structural bind, where liquidity, leverage, and price pressures are inseparable forces shaping the landscape.

THE MACRO RADAR Takeaway

The Fed isn’t charting a course—it’s negotiating with constraints. Inflation risk keeps them from easing, while weakening jobs and ballooning interest payments keep them from tightening. Debt is the real central banker now, and investors must position for a policy regime defined not by choice, but by necessity. We are preparing for more inflation, and we are now more selective on where the actual growth engines are.

From Signal to Strategy

At THE MACRO RADAR, we decode the signals. But signals alone don’t protect portfolios. That’s where THE MACRO GPS comes in—translating these warnings into actionable allocation strategies.

How much gold should sit in a portfolio?

What does the erosion of U.S. fiscal credibility mean for duration risk?

Where are the opportunities in a world where fiat is quietly debased?

These are not academic questions—they’re portfolio questions.

👉 Subscribe to THE MACRO GPS to move from narrative to navigation. Because in a world of paper promises, you don’t just need to see the storm—you need a map through it.

👉 Visit EdenHuang.com to learn more about how I can help you build resilience and clarity in a world of uncertainty.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

Terms of Use & Disclaimers:

“The Macro Radar”, "The Macro GPS" and “Wealth Strategy” sections of this newsletter are managed and written by Eden Huang, a representative of iFAST Global Markets, a division under iFAST Financial Pte Ltd.

The views and opinions expressed in this newsletter are those of the writer alone and do not necessarily reflect the views of any affiliated organization.

Views are based on information available at the time of writing and are subject to change as new economic data or market conditions emerge.

Information in this newsletter is intended for educational purposes and does not constitute personalized investment advice.

All materials and contents found in this newsletter should not be considered as an offer or solicitation to deal in any capital market products.

Future expectations outlined in this newsletter are based on available data and reasonable assumptions but are not assured. Economic trends and unforeseen events may alter outcomes.

If uncertain about the suitability of the product financing and/or investment product and/or asset allocation strategies, please seek advice from a licensed investment adviser, before making a decision to use the product financing facility and/or purchase the investment products.

Investment products involve risk, including the possible loss of the principal amount invested. Past performance is not indicative of future performance and yields may not be guaranteed.

While we try to provide accurate and timely information, there may be inadvertent omissions, inaccuracies, and typographical errors.

iFAST Global Markets: Terms and Conditions

This newsletter has not been reviewed by the Monetary Authority of Singapore.