This Month's Issue:

The Federal Reserve kept the fed funds rate steady during its January 2025 meeting. The Federal Reserve has decided to pause its recent series of rate cuts, holding its key lending rate steady at 4.25% to 4.5%. This decision comes amidst ongoing inflation concerns and a “robust” labor market, reflecting the Fed's cautious approach as it navigates the complexities of the current economic landscape.

The Situation Snapshot

The U.S. Fed Funds Rate has risen significantly since 2022 due to the inflationary forces we experienced in a post-pandemic era. Keeping the Fed Funds Rate higher for longer at 5.50% actually revealed quite a few cracks in the economy.

The fastest rate hikes in recent history have posed significant challenges for banks, primarily affecting their balance sheets. As rates rise, the market value of banks' existing bond holdings decreases, leading to unrealized losses. Furthermore, a higher for longer interest rate can keep borrowing costs elevated for consumers and businesses. Higher for longer Inflation and Interest rate has knock-on effects on economic growth that largely depends on spending within a consumption economy like the United States.

After constantly getting mixed and contradicting narratives from the mainstream media, analysts and anecdotal accounts of the real economy in the United States, we have since been more data dependent rather than trying to decipher all the mixed and contradicting narratives.

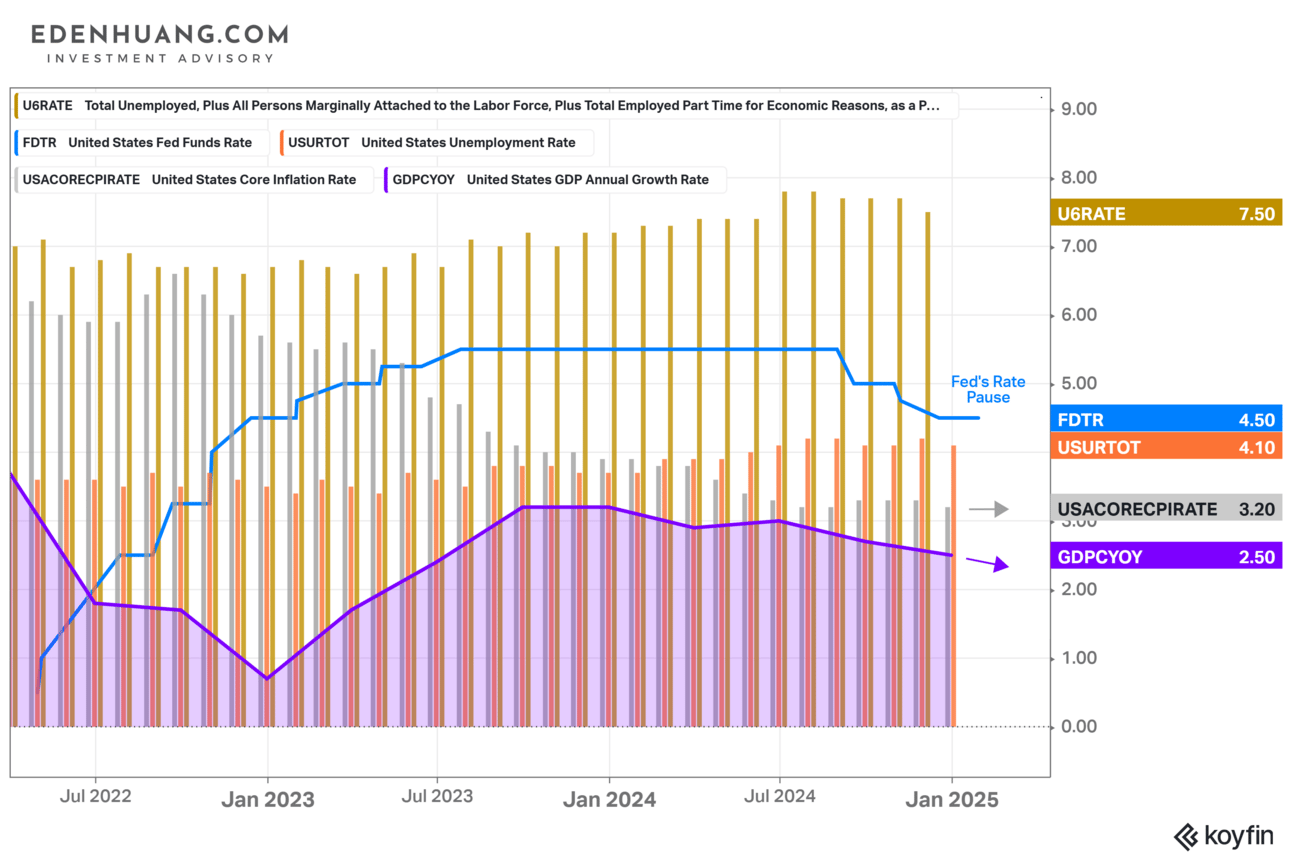

The following chart contains some important objective economic indicators that we track here at THE MACRO GPS:

As of 7th Feb 2025

The Fed Interest rate decisions that affect us all are closely tied to the inflation rate and the unemployment rate. This is because the United States Federal Reserve has a dual mandate to foster economic conditions that achieve both stable prices and maximum sustainable employment. Knowing this, the above chart gives a clearer snapshot of the interrelationship of these indicators.

Why the Fed HAD to Cut Rates?

Based on the above chart:

GDP Growth is slowing and Unemployment Rate actually ticked up in 2024.

The U-3 Unemployment rate that the U.S. releases is deemed as the official unemployment rate, which is known as the U-3 rate, or simply U3. It measures the number of people who are jobless but actively seeking employment.

The U3 gets the most media attention when released each month by the Bureau of Labor Statistics (BLS), but many economists view the U-6 rate as more meaningful because it covers a larger percentage of people who are unemployed.

U3 is often criticized for being too simple. Many economists believe it fails to take the whole picture into account because it includes only people who are actively seeking employment. It actually excludes individuals who work part-time but want full-time work and discouraged workers. The latter are also unemployed individuals who are able to work but haven’t looked for a job for the last four weeks.

Unlike the U3 rate, the U-6 unemployment rate includes a whole swath of unemployed people. It is seen by many as more in line with what it means to be unemployed.

Based on the above chart:

U6 unemployment rate actually ticked up faster in 2024. This could also mean that more Americans are taking up multiple part-time jobs to make ends meet. Personal consumption expenditures (PCE) account for approximately 68.2% of the U.S. GDP as of the fourth quarter of 2024. This means that a significant portion of the U.S. economy is driven by consumer spending on goods and services. If GDP growth is actually slowing down, then this is contrary to the robust job market and economy that the mainstream narratives are purporting…

Why the Rate Pause now?

Why not cut rates further since a low interest rate would be great for consumers and businesses? The problem this time around is the expanding Money Supply and its potential knock-on effects on price stability as seen in the following chart:

As of 7th Feb 2025

M2 Money Supply is expanding again in 2024 and about to return back to 2022 peak of $21.84 Trillion, even when interest rate reached 5.50% in 2024 to rein in the Money Supply to curb inflation. This begs the question: Is the peak of 5.50% Feds Funds Rate even high enough to win the inflation fight when the Money Supply can still expand this quickly in just one year without a pandemic?

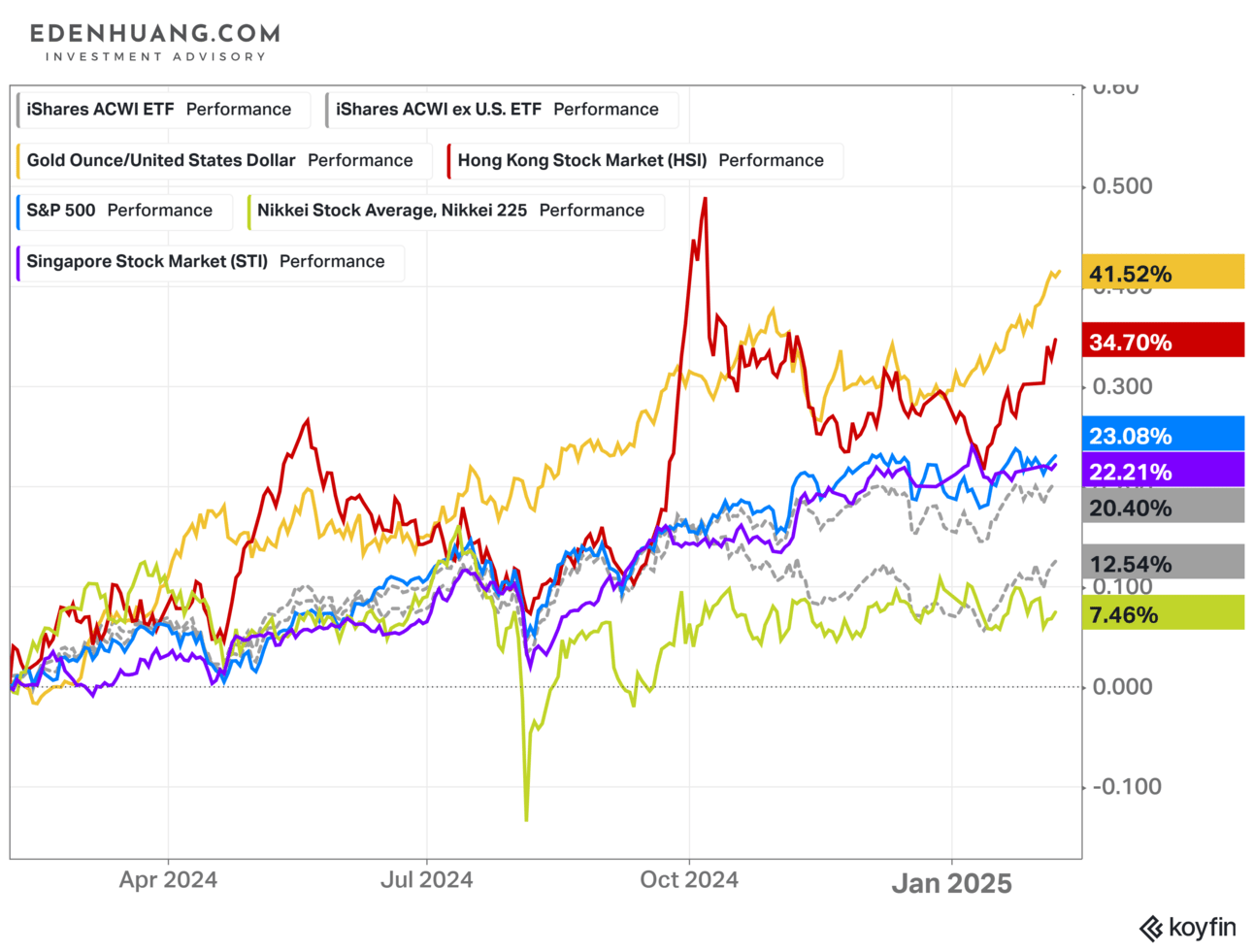

Inflation could pick up again when too much money supply is chasing limited goods and services. So far, in the capital markets, all hedging instruments against inflation and the debasement of currencies have performed very well. Gold for instance has outperformed even the S&P500 and most benchmarks in 2024. This could be like a canary in a coal mine, the market expectation for the coming years is mostly inflationary, based on the expanding money supply and the outperformance of Gold as seen in the following chart:

As of 7th Feb 2025

Chinese Tech Disruption

Chinese startup DeepSeek’s cheaper AI is sharpening investor scrutiny of the billions U.S. tech giants are pouring to develop the technology. The U.S. Magnificent Seven—Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta Platforms, and Tesla—have experienced an eye-watering rise in both price performance and market capitalization in 2024, largely fueled by their groundbreaking advancements in artificial intelligence (AI). These tech giants, which now account for one-third of the S&P 500 Index, collectively saw an average gain of 63% over the year, with Nvidia's market value soaring to $3.28 trillion. This remarkable growth underscores the pivotal role AI technology is playing in driving market dominance and investor enthusiasm.

As of 7th Feb 2025

In recent years, Chinese tech companies have made remarkable strides, surpassing U.S. tech giants in various domains. Companies like DeepSeek have revolutionized the AI landscape with cost-effective models that rival the performance of leading American AI systems. China's innovation in nuclear power, electric vehicles, and semiconductors has outpaced U.S. advancements, positioning the country as a global leader in these critical technologies. This shift underscores China's growing influence in the tech world and highlights the need for U.S. companies to innovate more strategically to maintain their competitive edge.

As of 7th Feb 2025

Chinese tech stocks have recently been outperforming the U.S. Magnificent Seven, driven by significant advancements in AI technology. For instance, the Hang Seng Tech Index, which includes major players like Tencent Holdings, Alibaba Group Holding, and Xiaomi, has rallied over 10% in the past two weeks. In contrast, the Magnificent Seven—Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Nvidia, and Tesla—have seen more modest gains. This surge in Chinese tech stocks is attributed to their attractive valuations and innovative AI models, such as DeepSeek's AI, which has been integrated into Alibaba's cloud computing services.

In this Section of THE MACRO GPS, we share our thoughts on how we view the Capital Markets. Every month we track and monitor:

U.S. Recession Indicators

Global Economic Conditions

Market Cycle Markers

Our Asset Allocation Strategy

The Macro GPS Performance Review

Subscribe to Non-Clients to read the rest.

Become a paying subscriber as Non-Clients to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦