This Month's Issue:

The Group of Seven (G7) is an intergovernmental political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. The European Union (EU) is also represented at the G7 meetings. The G7 was established in 1975 as the Group of Six (G6) by the heads of state and government of France, West Germany, Italy, Japan, the United Kingdom, and the United States. The first summit was held in Rambouillet, France, to address the global economic crisis caused by the oil shock and the collapse of the Bretton Woods system.

G7 Slowdown

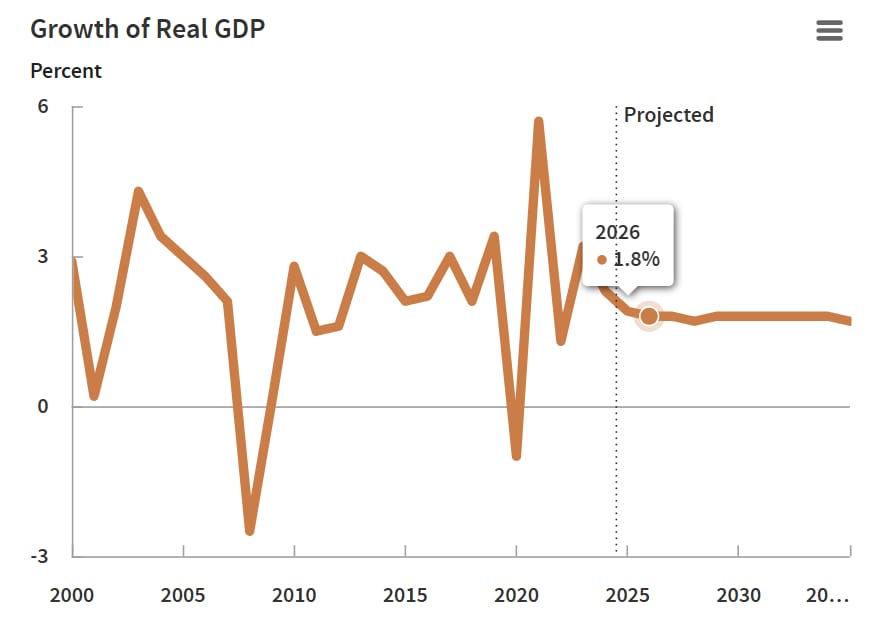

Now in 2025, the global dynamics have shifted. I have gotten quite a lot of pushbacks for acknowledging the fact that the growth of G7 countries is actually slowing down compared to Asia ex Japan economies as seen in the following chart:

The G7 economies are experiencing slower growth due to a combination of factors:

Inflation: High inflation rates have been a significant challenge, impacting consumer spending and business investments.

Global Economic Conditions: The global economic environment, including the aftermath of the COVID-19 pandemic and geopolitical tensions, has created uncertainties and disruptions.

Recession Indicators: Some G7 countries, like Germany, have faced economic recessions, further slowing overall growth.

Sectoral Slowdowns: Key sectors, such as manufacturing and services, have shown signs of slowing down, affecting overall economic performance.

These factors combined have contributed to the deceleration in growth among the G7 nations. Even the leader of the pact, the United States Congressional Budget Office (CBO) Budget and Economic Outlook: 2025 to 2035 is projecting U.S. economic growth to cool in calendar years 2025 and 2026 and then averages roughly 1.8 percent a year from 2027 to 2035 as seen in the following chart:

Divergence

As global investors, we are pragmatic and sensitive to these shifts in growth trends. If we were to observe the divergence of the global indices, the outflows from the U.S. have been met with inflows to other markets especially Hong Kong. Interestingly Hong Kong Exchange is where the “Terrific 10” stocks are listed. The “Terrific 10” refers to a group of leading Chinese tech firms, including Alibaba, Tencent, Meituan, Xiaomi, BYD, JD..com, NetEase, Baidu, Geely, and SMIC.

As of 7th March 2025

This divergence of other markets against the U.S. market, since Trump’s tariff threats and cost cutting measures which can generally be seen as contractionary for the U.S. economy, market flows could be signaling that investors are hedging against a projected and perceived U.S. economic slowdown by diversifying away to other markets and asset classes like Gold.

Therefore, our Asset Allocation Strategy of focusing on Gold and the Asia ex Japan markets since last year are objectively working and bearing fruits for us.

Powering Tomorrow: The Clean Energy Sector

In this issue, I want to revisit the clean energy sector after solidifying our entry to Gold and the Asian ex Japan markets. Considering the resurgence of Chinese tech and the projected economic slowdown of Western and European economies, I wanted to seek out a sector that has a clear competitive advantage that also possesses a high barrier of entry.

China is a manufacturing powerhouse, accounting for approximately 31% of global manufacturing output in 2022. This makes China the world's largest manufacturer, significantly ahead of the United States, which holds the second position. The value added by China's manufacturing sector in 2022 was over $5 trillion, contributing nearly 30% to the country's total economic output.

In 2024, China maintained its position as the world's largest manufacturer, contributing around 30% of the global manufacturing added value. This immense contribution underscores the sector’s critical role in global supply chains, influencing everything from consumer electronics to heavy machinery.

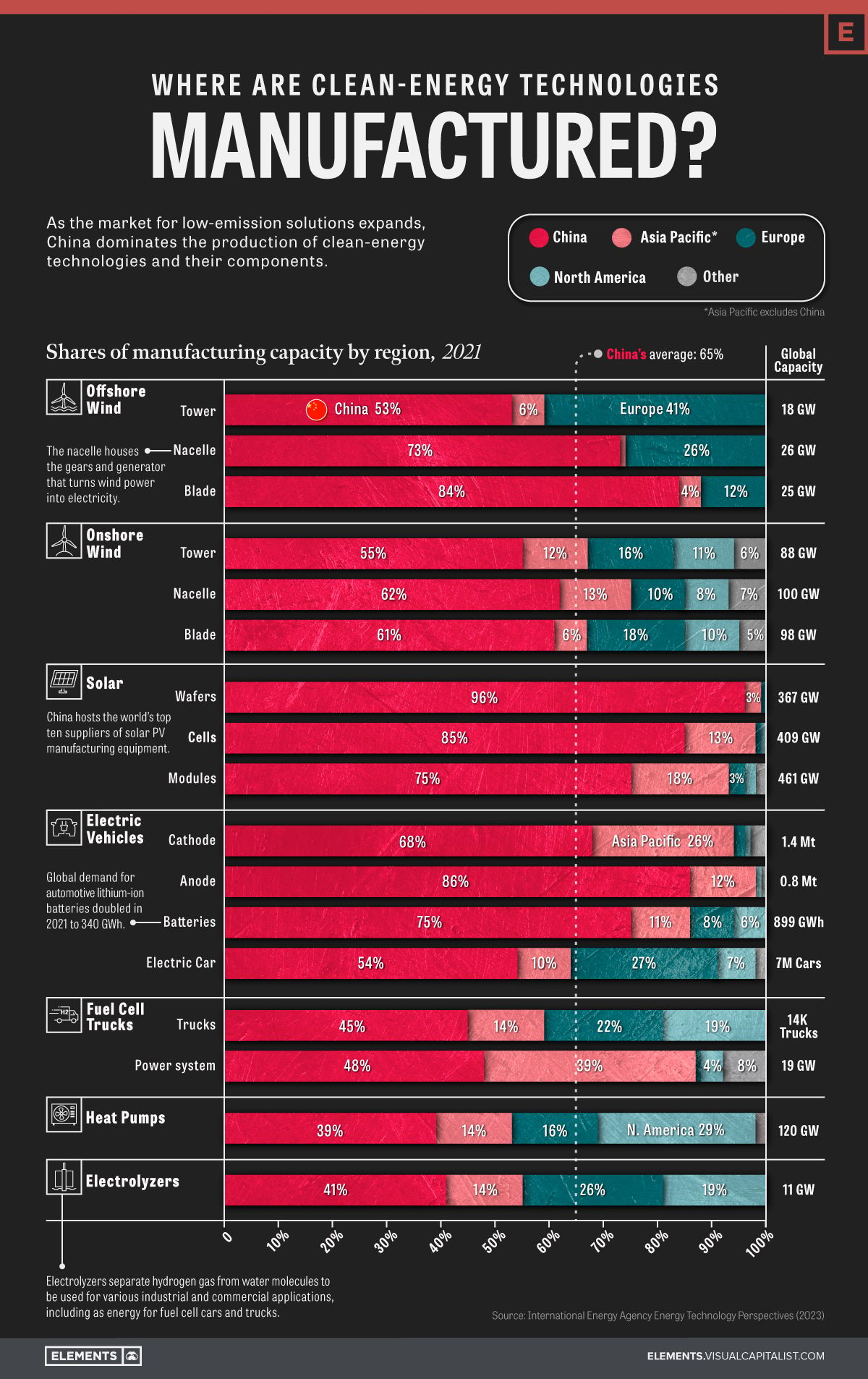

This brings us to where on earth are all the clean energy technologies manufactured?

China dominates this sector till this day, after decades of building up their manufacturing infrastructure and constantly perfecting their manufacturing processes and logistics:

It boggles my mind that this sector has so much competitive advantage and such a high barrier of entry and yet this sector has been underinvested for years. Climate change has already affected our global economy in many ways like rising temperatures and costs of energy in many advanced economies. Governments have also voiced concerns in recent years and have actively set aside substantial funding to push ahead with a clean energy transition and diversification away from fossil fuels.

Instead of investing in “contractors” that could benefit from China’s manufacturing prowess, I would rather focus on the main source of the clean energy transition.

Therefore, we have been actively looking into this sector since 2024. Staying ahead of the curve to position ourselves for the global clean energy transition.

In this Section of THE MACRO GPS, I share my thoughts on how I view the Capital Markets. Every month I track and monitor:

U.S. Recession Indicators

Global Economic Conditions

Market Cycle Markers

Our Asset Allocation Strategy

The Macro GPS Performance Review

Subscribe to Non-Clients to read the rest.

Become a paying subscriber as Non-Clients to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦