This Month's Issue:

Understanding Trump's Tariffs:

A Push for Trade Fairness or Economic Gamble?

Trump's tariffs have evolved beyond their initial role as negotiation tools and are now deeply embedded in the U.S. economy. Initially framed as a strategy to address trade imbalances and protect domestic industries, these tariffs have become a defining feature of the nation's economic landscape. Their widespread implementation has reshaped supply chains, altered consumer prices, and influenced global trade dynamics. While some argue that they have bolstered certain sectors, others highlight the long-term challenges, including inflationary pressures and strained international relations. This shift underscores the enduring impact of policy decisions on economic structures and global perceptions.

<How did we get here?>

Trump's tariffs stem from his long-standing belief that foreign nations exploit the U.S. through unfair trade practices. Initially, these tariffs were introduced to address trade imbalances and protect domestic industries, particularly against China. Over time, they expanded to include allies like Canada and the European Union, sparking trade wars and retaliatory measures. Framed as a push for economic fairness, these policies have reshaped global trade dynamics, with significant impacts on supply chains, consumer prices, and international relations. The escalation of these tariffs reflects a broader shift towards protectionist policies under Trump's administration.

<U.S. exploited by unfair trade practices?>

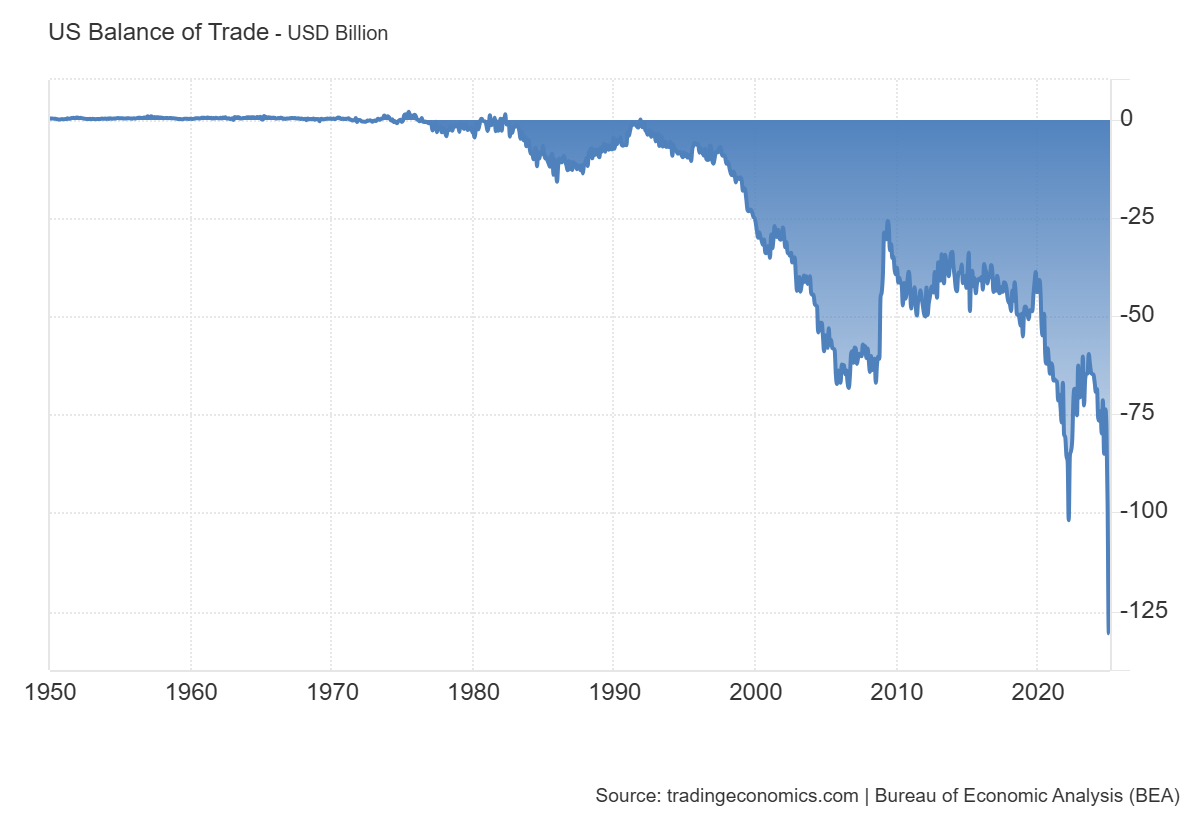

As a predominant consumption economy, the United States has a significant trade imbalance, with imports generally exceeding exports. For example, in February 2025, the U.S. trade deficit was approximately $122.7 billion, reflecting higher imports compared to exports. Key imports include consumer goods, automotive products, and electronics, while major exports consist of machinery, aircraft, and agricultural products.

Manufactured goods in the U.S. often come with higher price tags compared to imported goods due to several factors. Domestic production involves higher labor costs, stringent regulations, and elevated energy expenses, all of which contribute to increased manufacturing costs. In contrast, imported goods benefit from lower labor costs in countries with less stringent regulations and cheaper raw materials. This cost disparity makes imports more attractive to businesses and consumers seeking affordability.

Decades of outsourcing manufacturing to emerging markets have fundamentally reshaped the U.S. economy, contributing to the challenges faced today. In pursuit of lower labor costs and higher profit margins, many American companies shifted production overseas, taking advantage of relaxed regulations and cheaper resources in emerging markets. While this strategy boosted corporate profits and delivered more affordable goods to consumers, it also led to a decline in domestic manufacturing capabilities and job opportunities. The heavy reliance on global supply chains has left the U.S. vulnerable to disruptions, geopolitical tensions, and trade imbalances, highlighting the long-term consequences of prioritizing cost savings over economic self-sufficiency.

<Trump’s tariffs the last resort?>

The diminishing competitiveness of the U.S. in the global market has become a growing concern, driven by decades of outsourcing, aging industrial infrastructure, and rising production costs. Once a leader in innovation and manufacturing, the U.S. now faces challenges in keeping pace with emerging economies that benefit from lower labor costs and strategic investments in key industries. As global competition intensifies, protectionist policies such as tariffs and subsidies have emerged as a last resort to safeguard its mature domestic market from further erosion. These measures aim to shield American industries and workers, but they also risk stifling innovation, escalating trade tensions, and making long-term economic resilience harder to achieve.

<Why the urgency for Protectionist Policies now?>

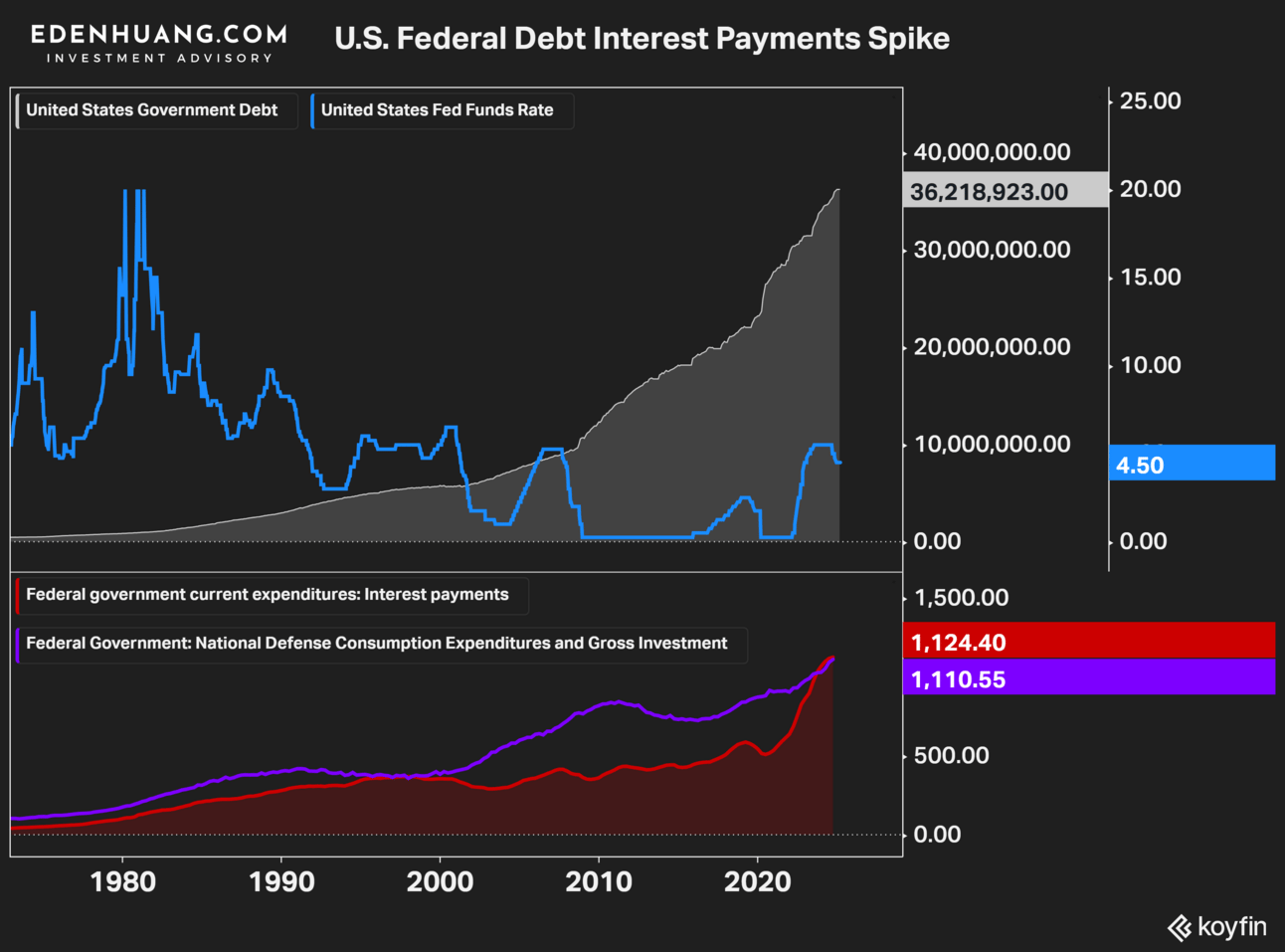

The U.S. federal debt's interest payments have become a significant and compounding burden on the nation's finances. As the government borrows more to fund its operations and programs, the interest owed on this debt grows, creating a cycle of increasing financial obligations. Rising interest rates further exacerbate this issue, as new debt is issued at higher costs, adding to the overall expense. As of FY2024, Interest Payments on the U.S. Federal Debt have reached $1Trillion level for the first time in U.S. history, and the top 3 line items of the U.S. Federal Budget, surpassing their entire defense budget.

This compounding nature means that a larger portion of the federal budget is allocated to servicing debt, leaving less room for essential investments in infrastructure, education, and healthcare. Over time, this dynamic poses challenges to fiscal sustainability and economic growth. Furthermore, to add fuel to the debt fire, more than $5 Trillion of Federal Debt will be maturing and require re-financing annually in the coming years.

The urgency of addressing interest payments on U.S. federal debt has never been more pressing. As debt levels continue to soar and interest rates rise, these payments are consuming an increasingly large share of the federal budget, limiting funds available for critical public investments like infrastructure, education, and healthcare. This financial strain is compounded by the compounding nature of debt, with new borrowing adding to future obligations at higher costs.

To avoid a spiral of escalating debt and economic instability, there is a critical need to lower budget deficits through fiscal policies, such as reducing unnecessary expenditures, enhancing revenue streams via taxes (aka Tariffs).

<What to expect in the coming years?>

In the coming years, these challenges are likely to be compounded by high refinancing needs, fluctuating interest rates, and global economic uncertainties. Persistent budget imbalances and protectionist policies could weaken the nation's financial standing, limit its ability to respond to future crises, and impact overall economic resilience.

Balancing the U.S. budget is a critical issue that carries significant implications for global investors. As the federal debt continues to rise and interest payments consume a growing share of the budget, the urgency to address deficits intensifies. In the coming years, investors can expect heightened volatility in U.S. Treasury markets, as refinancing needs and fluctuating interest rates create uncertainty. Additionally, the potential for fiscal consolidation or policy shifts may impact global capital flows and investment strategies.

For global investors, staying attuned to U.S. fiscal policies and their ripple effects on currency stability, bond yields, and economic growth will be essential in navigating this evolving global landscape.

THE MACRO GPS

In the following Sections we track and monitor:

Key U.S. recession indicators, such as unemployment trends, yield curve patterns, and consumer confidence indices, offer early signals of economic downturns, enabling proactive decision-making.

Global economic conditions, including GDP growth rates, trade dynamics, and inflation pressures, provide insights into the interconnected nature of economies and their cascading impacts on various markets.

Market cycle markers—help identify shifts in investment opportunities and risks. Together, these metrics allow investors stay ahead of economic trends and optimize their strategies for resilience and growth.

OUR ASSET ALLOCATION STRATEGY

In the following Sections, we share with clients and subscribers our asset allocation strategy based on Recession indicators, Global Economic Conditions, Market Cycle Markers. We will try to objectively tailor our advisory practice around the following asset allocation strategy.

Subscribe to Non-Clients to read the rest.

Become a paying subscriber as Non-Clients to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦