The Fed’s “Hawkish Cut”, Sticky Inflation, and a Shifting U.S. Dollar Landscape…

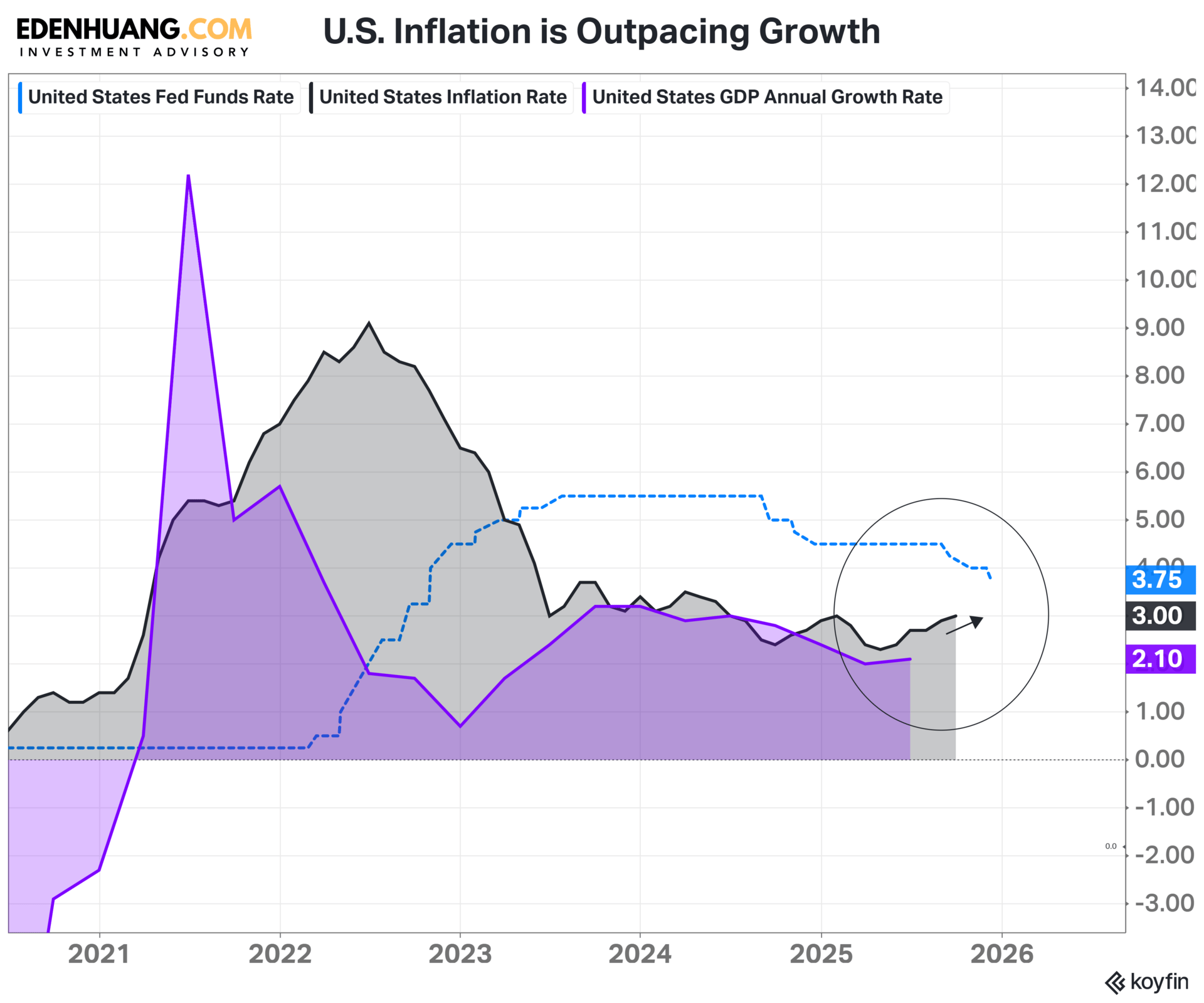

The past few months have delivered one of the strangest combinations in recent market history: the Federal Reserve has started cutting interest rates, yet its tone has grown more cautious, not more relaxed. This “hawkish cut” has confused many investors, but the message beneath it is straightforward. The Fed isn’t cutting because inflation is comfortably under control. It’s cutting because the system is showing signs of strain. Inflation remains sticky, long‑term borrowing costs are still elevated, and the U.S. economy is carrying a level of federal debt that makes high interest rates increasingly difficult to sustain.

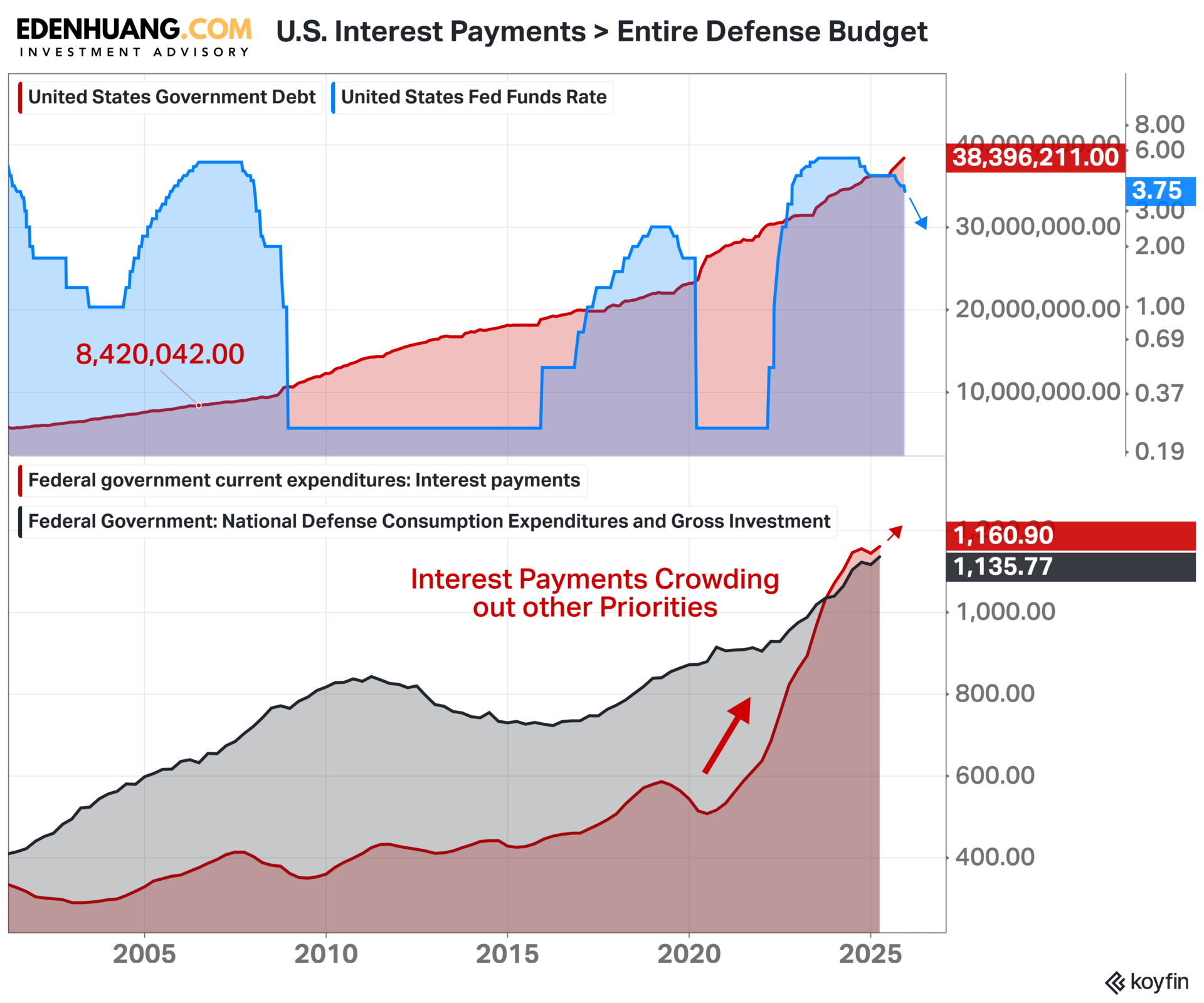

Put simply, the government’s interest bill has exploded. With debt at record levels, every percentage point in interest rates translates into hundreds of billions of dollars in additional payments. That pressure doesn’t just affect Washington, it spills into the broader economy, tightening financial conditions and raising the risk of something breaking. The Fed’s rate cuts are an attempt to relieve that pressure, even as it warns that inflation could flare back up if policy becomes too loose. Hence the paradox: cuts delivered with a warning label.

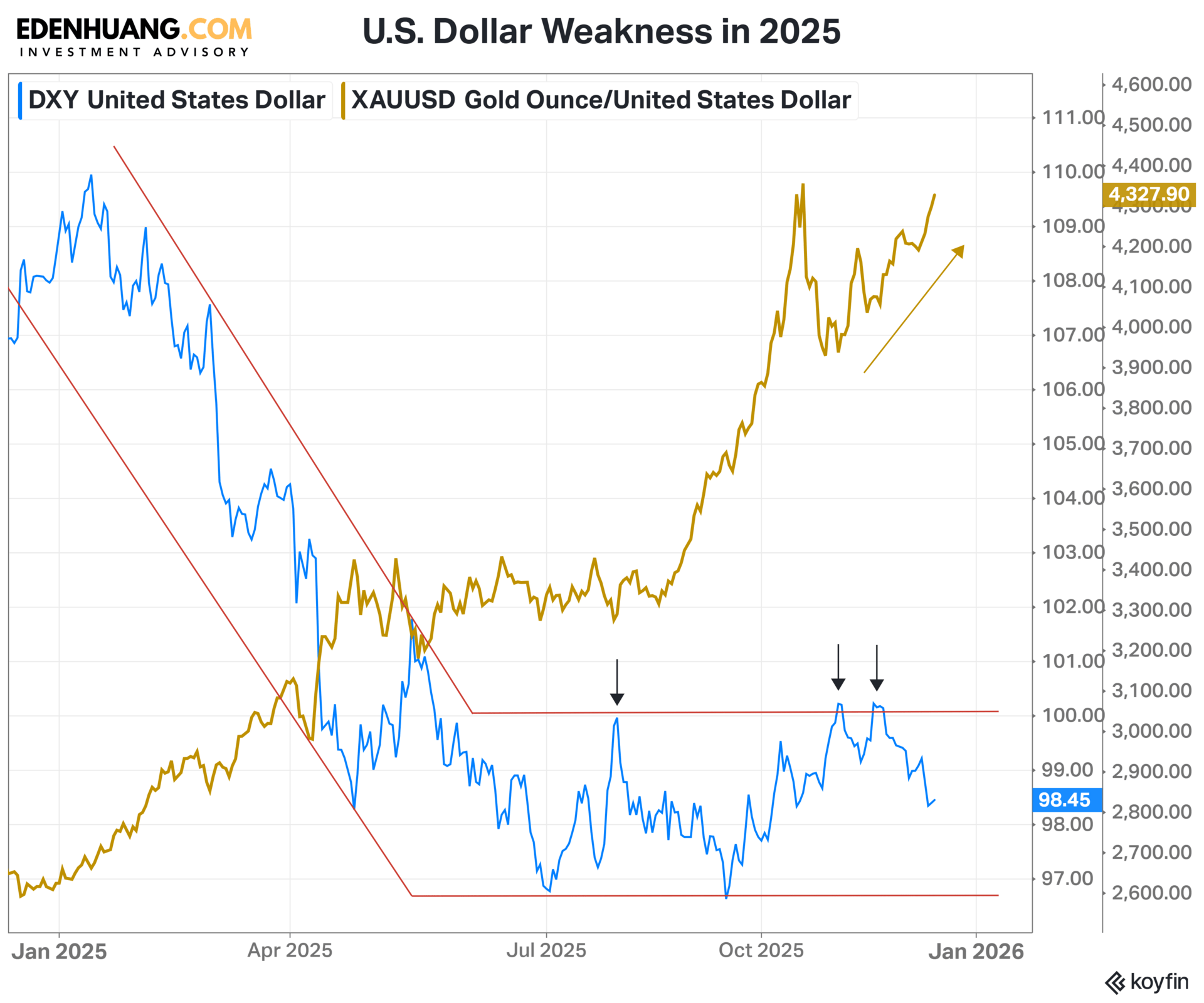

At the same time, the U.S. dollar has been sending mixed signals. It remains strong against many global currencies, but its dominance is no longer unquestioned. Countries are diversifying their reserves, trade flows are shifting, and the world is slowly adjusting to a more multipolar currency landscape. A strong USD tightens financial conditions globally, especially for emerging markets that borrow in dollars, while a weakening USD can trigger capital flows into commodities and non‑U.S. assets. Either way, the dollar’s movements have become a major driver of global market volatility.

Layered on top of this are geopolitical tensions, supply‑chain realignments, and rising concerns about fiscal sustainability in major economies. These forces don’t always make headlines, but they shape how capital moves, how currencies behave, and how investors position for the next phase of the cycle.

In this month’s issue of THE MACRO GPS, we break down these developments in plain language—why the Fed is cutting even as inflation lingers, how U.S. debt dynamics are reshaping policy, and what the shifting USD means for global markets. The goal is simple: to help you see through the noise and understand the deeper forces driving today’s volatility as we head into a new and more fractured global cycle.

Let’s dive in.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

This Month's Issue:

Upgrade to Gold Tier to read the rest.

Upgrade to Gold Tier to get access to this post and other Client-only content.

UpgradeAn Upgrade gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦