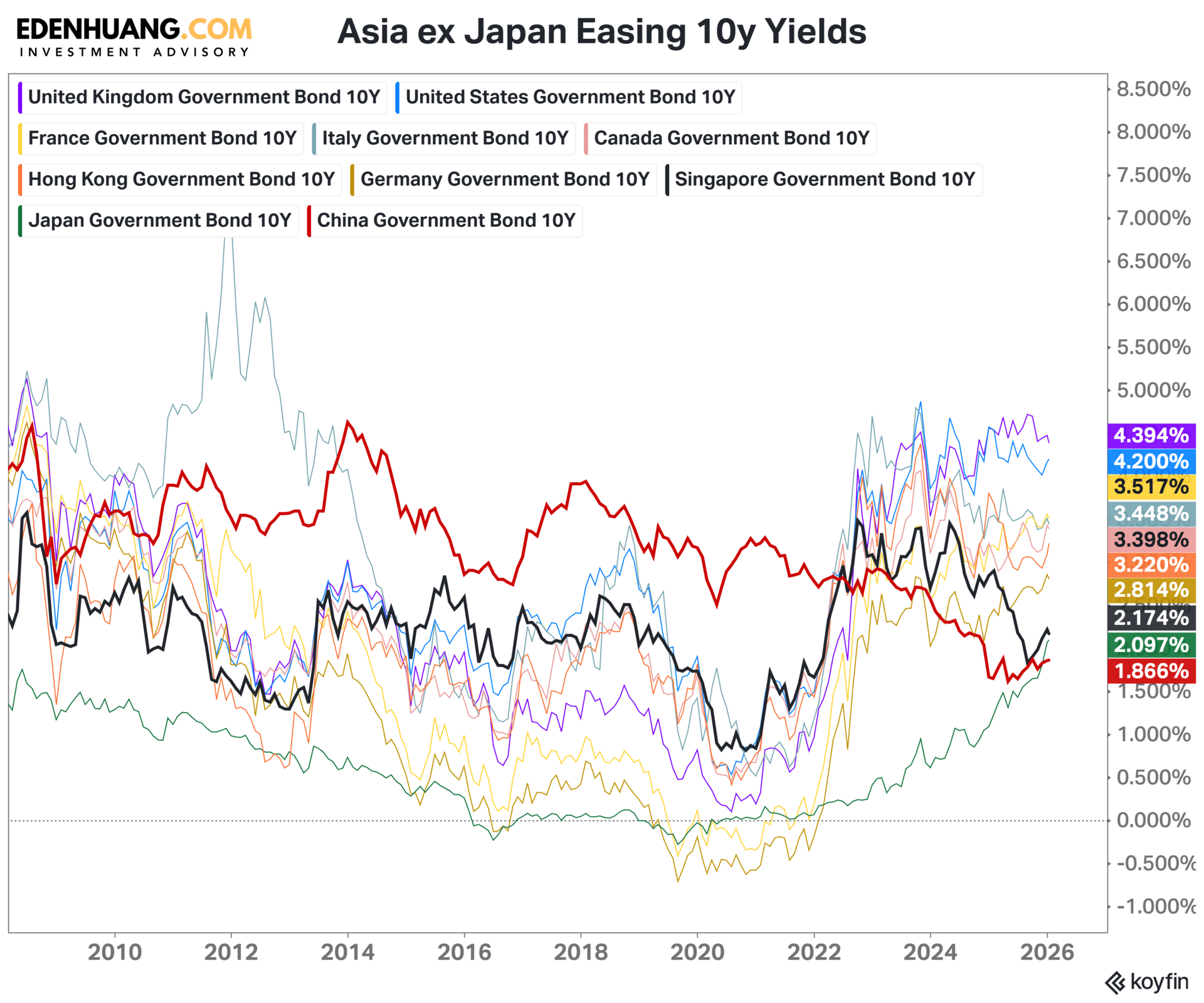

Rising G7 Yields, Falling Asian Yields: The New Macro Reality of 2026

G7 long‑term interest rates are shooting past their pre‑COVID levels, and it’s hitting everyone at once. Governments are paying more just to service their debt. Businesses face higher borrowing costs that slow expansion and squeeze valuations. Investors can no longer rely on the old “cheap money” world — the entire system is being repriced.

Why? Because almost everything in the economy is tied to the 10‑year yield. When it rises, borrowing gets more expensive for governments, companies, and households. It’s like the base fare on a taxi meter — once it jumps, every ride costs more. Budgets tighten, projects get shelved, and investors rethink what future returns are worth.

This isn’t a temporary spike. G7 yields have broken above their pre‑COVID range because inflation is stickier, deficits are larger, and bond markets are no longer willing to fund governments at bargain rates. The era of ultra‑low borrowing costs is over — and it’s not coming back.

But Asia ex‑Japan is telling a completely different story. Across the region, 10‑year yields are drifting lower, not higher. Singapore and China stand out: cooler inflation, tighter fiscal discipline, and slower credit growth are keeping long‑term rates stable. While the West battles rising costs, Asia is offering something rare — calm.

For investors, this divergence matters. Lower yields in Asia mean more room for policymakers to support growth, more attractive long‑duration opportunities, and a potential safe harbor in a world where borrowing costs are rising almost everywhere else.

In this month’s issue of THE MACRO GPS, we break down this global split in plain language — why G7 yields are climbing, why Asia’s are falling, and what this new macro map means for your capital in 2026.

Let’s dive in.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

This Month's Issue:

Upgrade to Gold Tier to read the rest.

Upgrade to Gold Tier to get access to this post and other Client-only content.

UpgradeAn Upgrade gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦