Gold is quietly reclaiming its role as the market’s compass—because investors sense that fiat currencies are losing purchasing power at the edges. The dollar still dominates global trade, yet beneath the surface, its strength feels more cyclical than structural. In this environment, gold is not just a hedge; it is a signal, pointing to the underlying unease about the durability of paper promises.

Inflation once declared ‘tamed,’ is showing signs of persistence. Supply chains have adjusted, but fiscal imbalances and expanding money supply keep embers glowing. The risk is not runaway inflation, but a resurgence strong enough to reprice the cost of money. For the 10-year Treasury, that means yields grinding higher—not only from inflation expectations, but from investors demanding a premium to hold long-duration debt in an era of fiscal strain.

The federal debt & Interest Payments sits at the center of this story. Rising yields translate directly into rising interest costs, crowding out other priorities and forcing difficult choices. The U.S. is entering a phase of fiscal dominance, where monetary policy is constrained by the government’s need to finance itself. The result is a feedback loop: inflation leads to rate hikes, rate hikes lead to fiscal strain, fiscal strain leads to monetary expansion, and monetary expansion circles back to inflation.

This issue of THE MACRO GPS maps these crosscurrents. Highlighting the pressures that will shape portfolios, policy, and positioning as we head into 2026. Gold, yields, debt, and interest payments are not isolated stories—they are interconnected signals. Reading them together is the only way to navigate the fog of the next cycle.

Let’s dive in.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

This Month's Issue:

THE COMPASS:

Gold & the Erosion of Trust

Gold’s rise isn’t a story of newfound brilliance—it’s a mirror reflecting the slow erosion of trust in fiat. Gold doesn’t yield. It doesn’t compound. It doesn’t promise anything. But it doesn’t lie either. Gold hasn’t become more valuable over time—it has simply remained constant while fiat currencies have eroded. As a fixed commodity with limited supply and no yield, gold doesn’t innovate or compound; it just sits there. What changes is the number of dollars, euros, or yen required to buy the same ounce of gold—or the same loaf of bread.

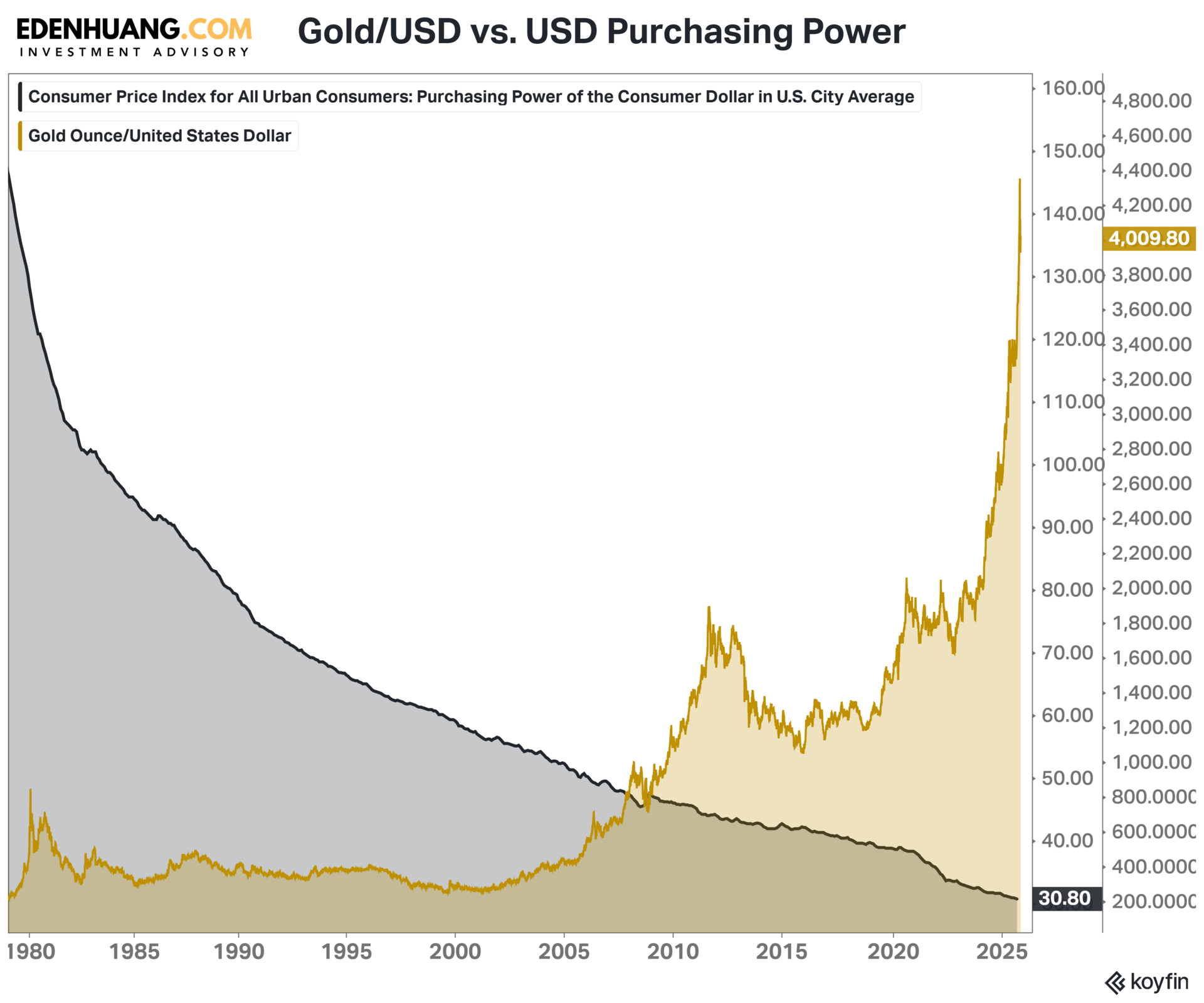

Since the 1980s, the price of gold in USD has surged from ~$400 to over $3,800 per ounce. That’s nearly a 10x increase.

Meanwhile, the purchasing power of the US dollar has steadily declined. According to the Consumer Price Index, what cost $1 in 1980 now costs over $3.50. In other words, the dollar has lost more than 70% of its value.

That shift isn’t driven by gold’s brilliance but by fiat’s fragility. Fiat currencies are engineered to lose purchasing power over time, a feature embedded in monetary policy. So, 𝘄𝗵𝗲𝗻 𝗴𝗼𝗹𝗱 “𝗿𝗮𝗹𝗹𝗶𝗲𝘀,” 𝗶𝘁’𝘀 𝗻𝗼𝘁 𝗴𝗼𝗹𝗱 𝘁𝗵𝗮𝘁’𝘀 𝗺𝗼𝘃𝗶𝗻𝗴—𝗶𝘁’𝘀 𝘁𝗿𝘂𝘀𝘁 𝗶𝗻 𝗳𝗶𝗮𝘁 𝘁𝗵𝗮𝘁’𝘀 𝘀𝗹𝗶𝗽𝗽𝗶𝗻𝗴.

THE PRESSURE GAUGE:

Inflation

Fiat currencies are not designed to preserve value; they are engineered to lose purchasing power over time. That is not a flaw of the system, it is the system. Every expansion of the M2 money supply—whether through stimulus, deficit financing, or central bank accommodation—dilutes the real value of existing currencies.

The chart makes this plain: as M2 money supply surged, the purchasing power of the dollar has steadily eroded, with inflation acting as the transmission mechanism between monetary expansion and lived reality. Inflation is not an accident; it is the inevitable byproduct of a system that relies on perpetual credit creation to sustain itself. The question for investors is not whether fiat will lose value, but at what pace—and how to position when that pace accelerates.

THE FAULT LINE:

Yields & Fiscal Strain

Inflation does not exist in isolation—it forces policymakers into action. A resurgence of inflation or when prices rise again, central banks or the bond market respond with higher interest rates. But those higher rates feed directly into the federal debt, ballooning interest payments and further swelling the deficit.

The U.S. federal government’s interest payments have now surpassed its defense budget and pushing into the top 3 line item of the federal budget. A historic inflection point that signals how debt servicing is crowding out fiscal flexibility. This reflects years of deficit spending and persistent issuance of debt in its own currency. As interest payments rise, the government’s ability to stimulate growth or respond to crises diminishes, increasing systemic fragility.

To cover the gap, the Treasury issues more debt, which the market can only absorb at ever-higher yields—or, eventually, with central bank balance sheet support. That support, in turn, expands the money supply, planting the seeds for the very inflation policymakers were trying to contain. It is a feedback loop: inflation leads to rate hikes, rate hikes lead to fiscal strain, fiscal strain leads to monetary expansion, and monetary expansion circles back to inflation.

THE MACRO GPS

In the following sections, I dive deeper into the narratives, and I share my asset allocation strategy based on:

Key Indicators

Global Economic Conditions

Market Cycle Markers

I will objectively tailor my advisory practice around the following asset allocation strategy and review the performance here regularly with:

Dividend Yields vs. Core Inflation Rates

Our Asset Allocation Strategy

THE MACRO GPS Performance Review

Upgrade to Gold Tier to read the rest.

Upgrade to Gold Tier to get access to this post and other Client-only content.

UpgradeAn Upgrade gets you:

- Regular Macro Updates via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗥𝗔𝗗𝗔𝗥

- Monthly Macro Analysis and Asset Allocation Strategy via 𝗧𝗛𝗘 𝗠𝗔𝗖𝗥𝗢 𝗚𝗣𝗦