Why Global Investors Should Anchor in SGD

Global investors often start with USD as their base currency because it dominates global trade and finance. But if your goal is resilience first, growth second, the smarter anchor is the Singapore Dollar. SGD is one of the few currencies in the world that is engineered for stability, not left to the mercy of political cycles, fiscal theatrics, or speculative flows. MAS manages the exchange rate as its primary monetary policy tool, which means SGD is intentionally kept on a disciplined, low‑volatility path. For global investors, that makes SGD not just a currency — but a risk‑management foundation.

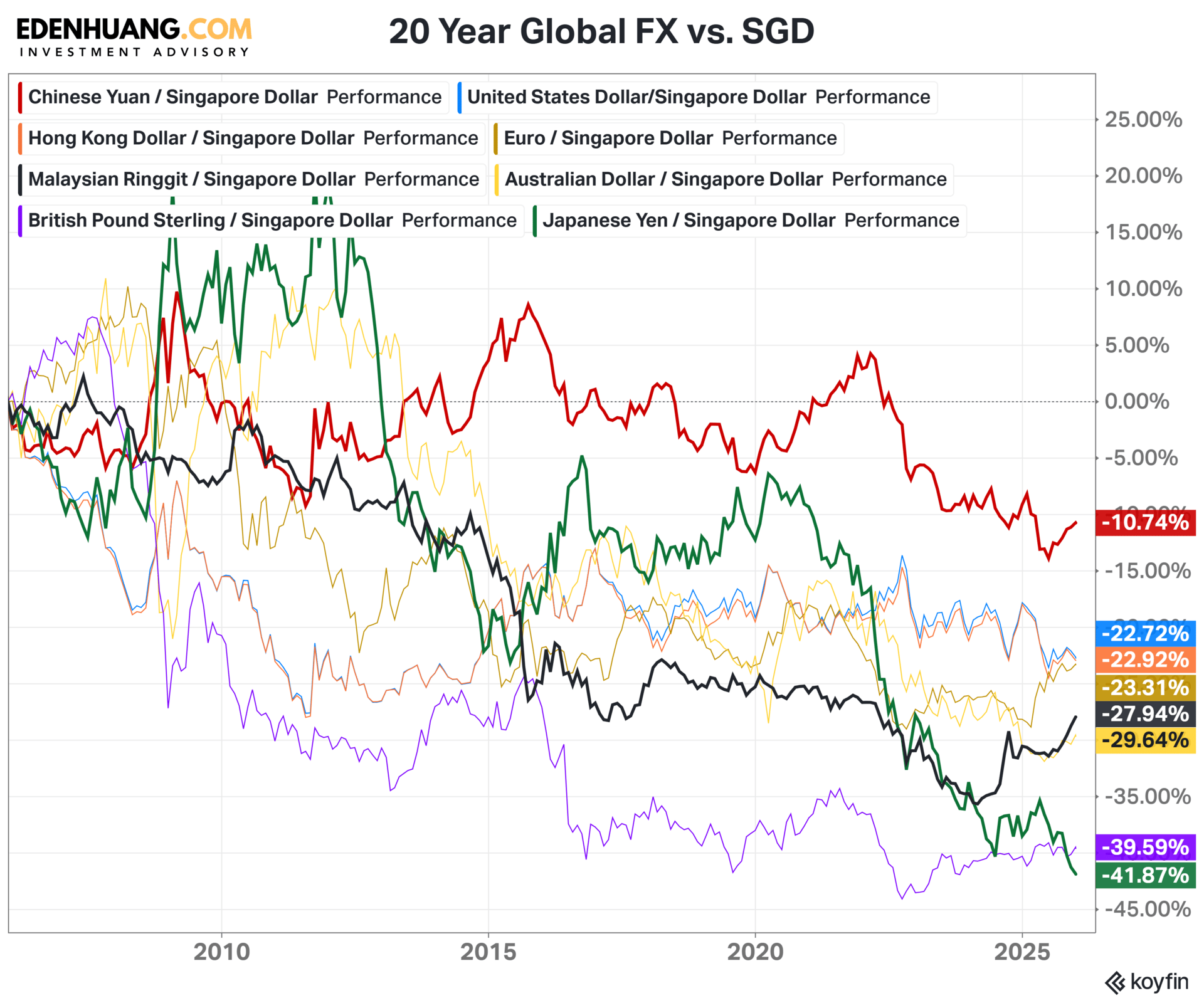

Over the last 20 years, the Singapore Dollar has quietly but decisively strengthened against most major global currencies — a testament to MAS’s disciplined, currency–driven monetary policy. SGD has appreciated against the USD, EUR, GBP, JPY, AUD, HKD, MYR, and even the Chinese Yuan.

Chinese Yuan emerges as the least volatile

Down just 10.74% against SGD. The Chinese Yuan (CNY) has emerged as the least volatile currency against the Singapore Dollar over the last 20 years because both countries operate managed exchange‑rate regimes that prioritizes stability over market-driven swings. China tightly controls the CNY through a managed float system, limiting sharp movements, while Singapore manages the SGD as its primary monetary policy tool to keep inflation in check. When two currencies are both guided by policy rather than left entirely to market forces, their long‑term movements tend to be smoother and more predictable. That’s why, in the 20‑year chart, the CNY shows the smallest decline against the SGD — not because it is stronger than other currencies, but because its path is more controlled and less exposed to the volatility seen in fully free‑floating currencies.

Japanese Yen - The Standout Worst Performing

Down over 41% against SGD. The Japanese Yen (JPY) has been the most volatile and weakest‑performing currency against the Singapore Dollar over the last 20 years because Japan has spent decades in a low‑growth, low‑inflation environment while maintaining ultra‑loose monetary policy. The Bank of Japan kept interest rates near zero or negative for much of this period, while other central banks tightened, widening yield differentials and putting persistent downward pressure on the Yen. At the same time, Japan’s aging population, slow domestic demand, and repeated rounds of quantitative easing added to long‑term currency weakness. When you compare this to Singapore’s disciplined, exchange‑rate‑driven policy framework, the result is clear in the chart: JPY/SGD shows the steepest decline and the widest swings, making the Yen the most volatile currency against the SGD over the past two decades.

Malaysian Ringgit - The Dark Horse

The Malaysian Ringgit (MYR) stands out as the dark horse against the Singapore Dollar over the last 20 years because, despite political transitions and economic uncertainty, it has held up better than many expected. Even through leadership changes — including the period under Prime Minister Anwar Ibrahim — Malaysia maintained steady trade flows, strong commodity demand, and a diversified economic base that helped cushion the Ringgit from deeper long‑term depreciation. While MYR has weakened against the SGD, its performance has been more resilient than currencies like the Yen or the Pound, making it a quiet outperformer in the long‑run FX landscape.

Why Forex Matter More Than Ever in 2026

Currencies matter more than ever going into 2026 because governments around the world are running large deficits and creating more money to fund their spending. When countries borrow heavily and expand their money supply, their currencies tend to weaken over time. That affects everything — from investment returns to the real value of savings. This is why understanding how global currencies move against the Singapore Dollar is so important. Over the last 20 years, the SGD has strengthened against every major currency in the chart, showing how disciplined monetary policy protects purchasing power. The Chinese Yuan has been the most stable against the SGD, while the Japanese Yen has been the weakest performer. The Malaysian Ringgit, despite political and economic noise, has held up better than many expected. As we head into 2026, currencies will tell you which countries are managing their finances responsibly and which are relying too much on debt and money creation. For global investors, ignoring FX means ignoring one of the clearest signals of long‑term financial health.

FROM SIGNAL TO STRATEGY

At THE MACRO RADAR, we decode the signals. But signals alone don’t protect portfolios. That’s where THE MACRO GPS comes in, translating these signals into actionable allocation strategies.

👉 Clients can keep a Lookout for THE MACRO GPS monthly issue to move from narrative to navigation.

👉 Visit EdenHuang.com to learn how I can help build clarity in a world of uncertainty.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

Terms of Use & Disclaimers:

“The Macro Radar” and "The Macro GPS" of this newsletter are managed and written by Eden Huang, a representative of iFAST Global Markets, a division under iFAST Financial Pte Ltd.

The views and opinions expressed in this newsletter are those of the writer alone and do not necessarily reflect the views of any affiliated organization.

Views are based on information available at the time of writing and are subject to change as new economic data or market conditions emerge.

Information in this newsletter is intended for educational purposes and does not constitute personalized investment advice.

All materials and contents found in this newsletter should not be considered as an offer or solicitation to deal in any capital market products.

Future expectations outlined in this newsletter are based on available data and reasonable assumptions but are not assured. Economic trends and unforeseen events may alter outcomes.

If uncertain about the suitability of the product financing and/or investment product and/or asset allocation strategies, please seek advice from a licensed investment adviser, before making a decision to use the product financing facility and/or purchase the investment products.

Investment products involve risk, including the possible loss of the principal amount invested. Past performance is not indicative of future performance and yields may not be guaranteed.

While we try to provide accurate and timely information, there may be inadvertent omissions, inaccuracies, and typographical errors.

iFAST Global Markets: Terms and Conditions

This newsletter has not been reviewed by the Monetary Authority of Singapore.