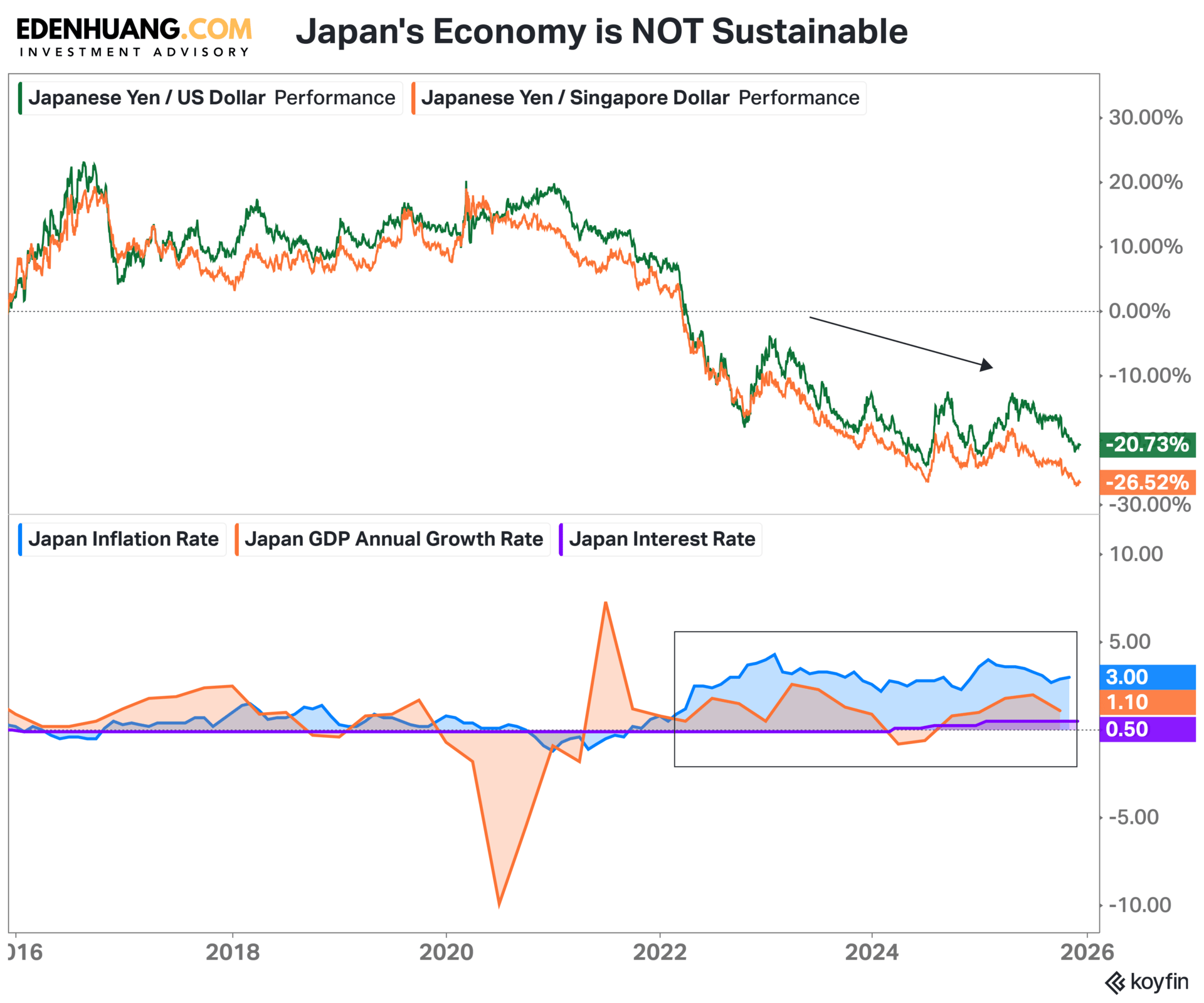

For decades, Japan was the emblem of deflation and ultra‑loose monetary policy. A nation where growth was sluggish, but stability seemed assured. That narrative has shifted. Inflation has surged, with consumer prices rising 3% year‑on‑year in Q3 2025, while GDP growth barely scrapes 1% annually. The result is a widening gap between rising costs and stagnant incomes, leaving households squeezed and increasingly disillusioned. The Bank of Japan’s reluctance to tighten policy has allowed the yen to remain perpetually debased, eroding purchasing power and amplifying frustration across the Japanese society.

Economic pain is reshaping Japan’s political landscape. Rising living costs without commensurate wage growth have fueled frustration, eroding trust in institutions. In the July 2025 Upper House elections, the far‑right Sanseitō party expanded its representation from one seat to fourteen, while populist parties gained nationally, costing Prime Minister Shigeru Ishiba’s coalition its majority. Right‑wing conservative movements are capitalizing on this moment, offering nationalist narratives that promise stronger borders, cultural preservation, and more assertive economic policies. For voters squeezed by inflation and a weak yen, these messages resonate as a call to reclaim control. Japan’s political shift matters beyond its borders. A more conservative Japan could:

Alter regional alliances and defense postures in the Asia‑Pacific.

Pursue remilitarization plans, destabilizing the Asia-Pacific.

Pursue protectionist trade policies, reshaping supply chains.

Influence global markets, as domestic instability affects currency volatility and capital flows.

Bond Market Stress

Japan’s bond market is flashing red. In December 2025, 10‑year Japanese Government Bond (JGB) yields hit their highest level since 2007, a direct consequence of BOJ inaction as inflation outpaces growth. Investors now demand higher yields to compensate for rising inflation risk and doubts about the BOJ’s credibility. With government debt exceeding 230% of GDP, Japan’s fiscal position is already precarious. The recent surge in bond yields has laid bare this fragility, signaling to investors that the country’s debt dynamics are increasingly unsustainable. Rising yields not only raise the cost of servicing Japan’s massive debt load but also undermine confidence in the Bank of Japan’s ability to maintain stability.

Global Implications

The consequences extend far beyond Tokyo: as investors demand higher compensation for risk, spillover effects ripple across global markets. U.S. Treasuries and European bonds are directly influenced, with yield curves shifting in response to Japan’s instability. This dynamic adds volatility to international portfolios, complicates duration risk management, and heightens uncertainty for global policymakers who must now contend with the knock‑on effects of Japan’s fiscal strain.

Global Implications

Japan’s instability matters far beyond its borders:

Currency volatility distorts trade balances, impacting exporters and importers worldwide.

Capital flows shift as households chase risk assets to hedge against inflation.

Geopolitical risk rises as conservative politics reshape Asia‑Pacific alliances and defense postures.

Bond market spillovers affect global yields, adding uncertainty to international portfolios.

THE MACRO RADAR Takeaway

𝗝𝗮𝗽𝗮𝗻’𝘀 𝘀𝘁𝗿𝘂𝗴𝗴𝗹𝗲 𝗶𝘀 𝗮 𝗰𝗮𝘂𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝘁𝗮𝗹𝗲: when central banks ignore debt and inflationary realities, the social contract frays, and political landscapes shift. What we are witnessing in Japan is not an isolated imbalance, it is a live demonstration of how monetary complacency collides with real‑world costs. Inflation has eroded household purchasing power, bond yields are surging as investors demand compensation for risk, and political discontent is fueling the rise of nationalist movements.

For global investors, Japan is more than a case study, it is a warning signal. Currency volatility distorts trade flows, debt fragility threatens bond markets, and political shifts reshape Asia‑Pacific alliances. These dynamics ripple outward, influencing U.S. Treasuries, European yields, and global capital allocation. Policymakers should take note: ignoring structural debt burdens and inflationary pressures is not a path to stability, but to fragility.

From Signal to Strategy

At THE MACRO RADAR, we decode the signals. But signals alone don’t protect portfolios. That’s where THE MACRO GPS comes in, translating these signals into actionable allocation strategies.

👉 Lookout for THE MACRO GPS monthly issue to move from narrative to navigation.

👉 Visit EdenHuang.com to learn how I can help build clarity in a world of uncertainty.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

Terms of Use & Disclaimers:

“The Macro Radar” and "The Macro GPS" sections of this newsletter are managed and written by Eden Huang, a representative of iFAST Global Markets, a division under iFAST Financial Pte Ltd.

The views and opinions expressed in this newsletter are those of the writer alone and do not necessarily reflect the views of any affiliated organization.

Views are based on information available at the time of writing and are subject to change as new economic data or market conditions emerge.

Information in this newsletter is intended for educational purposes and does not constitute personalized investment advice.

All materials and contents found in this newsletter should not be considered as an offer or solicitation to deal in any capital market products.

Future expectations outlined in this newsletter are based on available data and reasonable assumptions but are not assured. Economic trends and unforeseen events may alter outcomes.

If uncertain about the suitability of the product financing and/or investment product and/or asset allocation strategies, please seek advice from a licensed investment adviser, before making a decision to use the product financing facility and/or purchase the investment products.

Investment products involve risk, including the possible loss of the principal amount invested. Past performance is not indicative of future performance and yields may not be guaranteed.

While we try to provide accurate and timely information, there may be inadvertent omissions, inaccuracies, and typographical errors.

iFAST Global Markets: Terms and Conditions

This newsletter has not been reviewed by the Monetary Authority of Singapore.

Social & Political Strain