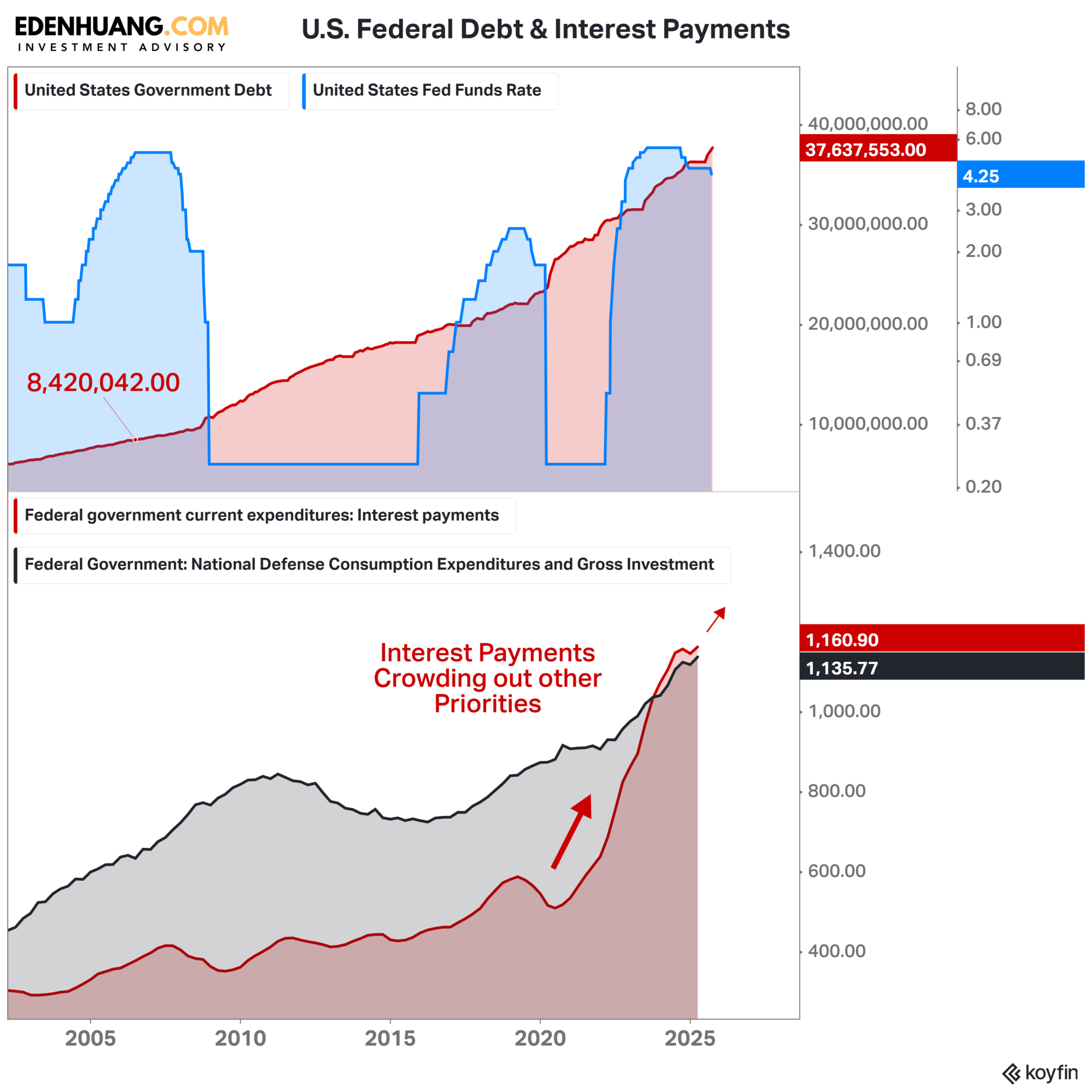

In 2008, when the Fed hiked rates into the teeth of a financial crisis, the U.S. carried less than $10 trillion in federal debt. Interest payments barely registered as a systemic constraint—Washington could still borrow cheaply, and the cost of capital didn’t immediately cannibalize the budget. Fast forward to 2025: the same rate hike packs an entirely different punch. With federal debt now north of $37 trillion, every percentage point in rates translates into hundreds of billions in additional interest expense. What was once a cyclical policy lever has become a structural choke point.

The symbolism is staggering: the United States now spends more on servicing past debt than on defending its future. Interest expense has quietly overtaken the Pentagon’s budget, meaning bondholders are extracting a larger annual claim on national resources than the generals tasked with projecting American power. This inversion of priorities is not just a budgetary quirk—it’s a geopolitical signal. A nation that once financed wars with debt now fights to finance the debt itself. The world’s reserve currency is being hollowed out from within, not by foreign adversaries, but by compounding interest.

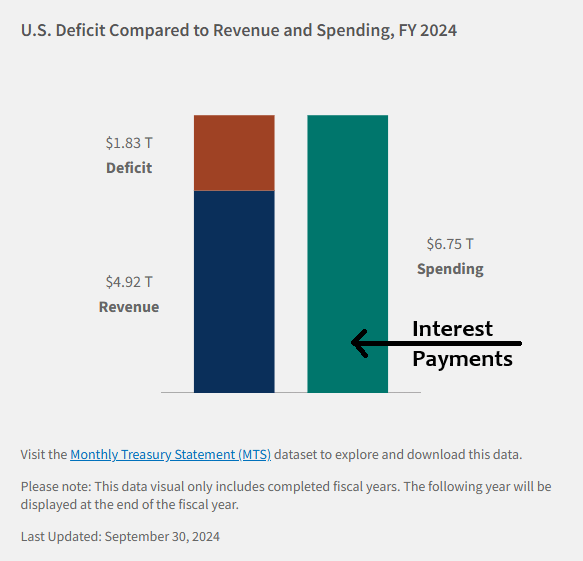

What makes this moment even more destabilizing is how interest expense is no longer a background line item—it’s climbing to the very top of the federal budget. In 2025, debt service is competing head‑to‑head with Social Security and Medicare as the largest single category of federal spending. Every dollar funneled to bondholders is a dollar not spent on infrastructure, education, or even the Pentagon. This is the essence of crowding out: the past consuming the future. Fiscal policy has been reduced to triage, where lawmakers debate not what to fund, but what to sacrifice, while interest quietly claims first rights on the nation’s revenues.

With tax hikes politically untouchable—blocked by entrenched interest groups—the federal government has turned to tariffs as a backdoor revenue stream, exporting the cost of fiscal dysfunction onto consumers. But tariffs are a blunt instrument: they inflate prices at home while straining global supply chains abroad. Meanwhile, Washington has been paralyzed since October 1st, 2025, as partisan deadlock over spending cuts and entitlements forced yet another government shutdown. The irony is brutal: in the name of protecting taxpayers, policymakers are imposing hidden taxes through tariffs and shuttered services, leaving the average American to pay the bill twice—once at the checkout line, and again in lost public services.

THE MACRO RADAR TAKE

The U.S. fiscal trajectory has entered a new regime where interest expense is no longer a background cost—it is the budget. Surpassing defense, crowding out entitlements, and forcing tariffs as a substitute for political courage, debt service has become the defining macro variable of this cycle. For global investors, this isn’t just an American problem—it’s a systemic one. The reserve currency is being hollowed out from within, and capital allocation must adapt accordingly. That means rethinking duration risk, diversifying away from U.S. fiscal fragility, and positioning for volatility in both rates and FX. At THE MACRO RADAR, we frame the narrative; at THE MACRO GPS, we translate it into portfolio strategy—helping you navigate the storm with conviction.

Keep a lookout for our monthly THE MACRO GPS issue

I’ve helped clients rethink their approach to wealth, and I’m here to help you do the same. Whether you're just starting out or recalibrating mid-journey, let’s make sure your assets are working for you—not the other way around.

👉 Subscribe to The Macro GPS for insights that cut through the noise.

👉 Keep in touch to build equity the right way—with clarity and conviction.

Sincerely,

Assistant Director

Investment Advisory

iFAST Global Markets

Terms of Use & Disclaimers:

“The Macro Radar”, "The Macro GPS" and “Wealth Strategy” sections of this newsletter are managed and written by Eden Huang, a representative of iFAST Global Markets, a division under iFAST Financial Pte Ltd.

The views and opinions expressed in this newsletter are those of the writer alone and do not necessarily reflect the views of any affiliated organization.

Views are based on information available at the time of writing and are subject to change as new economic data or market conditions emerge.

Information in this newsletter is intended for educational purposes and does not constitute personalized investment advice.

All materials and contents found in this newsletter should not be considered as an offer or solicitation to deal in any capital market products.

Future expectations outlined in this newsletter are based on available data and reasonable assumptions but are not assured. Economic trends and unforeseen events may alter outcomes.

If uncertain about the suitability of the product financing and/or investment product and/or asset allocation strategies, please seek advice from a licensed investment adviser, before making a decision to use the product financing facility and/or purchase the investment products.

Investment products involve risk, including the possible loss of the principal amount invested. Past performance is not indicative of future performance and yields may not be guaranteed.

While we try to provide accurate and timely information, there may be inadvertent omissions, inaccuracies, and typographical errors.

iFAST Global Markets: Terms and Conditions

This newsletter has not been reviewed by the Monetary Authority of Singapore.